How Italy Is Adapting to Its Latest iGaming and Betting Regulations Reform

Italy’s betting and iGaming industry is going through one of its biggest shake-ups since online gambling was first regulated in the late 2000s.

Introduction: A Sector Under Deep Transformation

A sequence of wide-ranging reforms introduced from 2023 to 2025 is changing the way licences are issued, how users confirm their identity, and how the watchdog supervises the market. The broader aim is to build a safer, clearer, and more durable ecosystem, cutting down on fragmentation and aligning Italy with European standards.

A standout move arrived in 2025: a €7-million licensing fee for remote gambling concessions. Together with stricter compliance demands, this step is nudging the market toward a smaller pool of stronger, better-funded operators. In practice, it signals the start of a fresh chapter for Italian iGaming.

Historical Context: A Complex and Evolving System

From Fragmentation to Centralised Oversight

Italy’s rules for gambling have grown through layers of parliamentary decrees, regional measures, and national updates. As described in the “Gambling in Italy” entry on Wikipedia, gambling is lawful only when state-authorised, with the Agenzia delle Dogane e dei Monopoli (ADM) acting as the main regulator.

For a long time, the key issue was inconsistency. Local regions set their own standards for retail betting locations, while online operators followed rules at the national level. That split produced uneven requirements and plenty of compliance uncertainty. ADM reports have repeatedly pointed to efforts to standardise supervision, yet the speed of digital growth made full coordination hard to maintain.

Why Reform Became Necessary

Entering the early 2020s, lawmakers were dealing with multiple pressure points:

- A fast-expanding digital market that legislation struggled to keep up with

- A sweeping advertising prohibition from the 2018 Dignity Decree that limited communication, even when intended to educate, creating grey zones and penalties (see analysis by DLA Piper).

- Uneven regional policies for physical betting outlets.

- A noticeable rise in offshore sites operating without permission.

- Growing worries around player safety, particularly for younger audiences.

The 2023–2025 package is meant to tackle these problems through a more unified approach supported by technology.

The 2025 Licensing Overhaul: A €7-Million Barrier to Entry

In 2025, Italy rolled out its toughest condition so far: a €7-million concession fee for online operators joining the next licensing cycle. Industry coverage from SBC News notes that this jump, along with limits on how many concessions can be granted, is set to cut down fragmentation across the market.

The financial hurdle is designed to:

- Keep participation limited to operators with real capital and proven compliance.

- Make supervision easier by focusing oversight on fewer licence holders.

- Push companies to invest for the long haul in safer-gambling systems.

Even if debated, the policy places Italy closer to countries like Denmark and Spain, where high-threshold licensing is tied to strict regulatory expectations. UK is also promulgating licensing policies for the British betting sites.

Stronger Player Protection Measures

Identity Verification and Responsible Gambling Tools

Italy is reinforcing identity checks to reduce fraud, block underage access, and strengthen anti-money-laundering controls. A major part of this is the coupling of KYC with SPID, the national digital identity system. SPID-based onboarding has become a core registration standard, as shown in guides explaining SPID verification.

This sits in line with wider European trends toward tighter digital identity assurance. According to igamingtoday.com, operators are expected to use dynamic risk profiling, adjustable spending limits, and real-time detection of harmful play patterns.

Self-Exclusion and Monitoring Improvements

ADM has expanded integrated self-exclusion databases and added behavioural analytics to catch risky betting behaviour earlier. With stronger real-time data access requirements, the regulator is aiming to step in sooner than in past frameworks.

Reorganisation of Land-Based Betting Shops

Italy’s retail betting scene, including long-standing Horse Racing outlets, has historically operated under uneven regional standards, especially for licensing rules and minimum distances from schools or other sensitive places.

The 2023–2024 reforms bring in:

- Nationally consistent distance requirements.

- A simpler authorisation route.

- Closer coordination between municipalities and ADM.

Investigative reporting from La Via Libera highlights how politically delicate these changes can be, since towns often have to weigh public-health concerns against the economic role of betting venues.

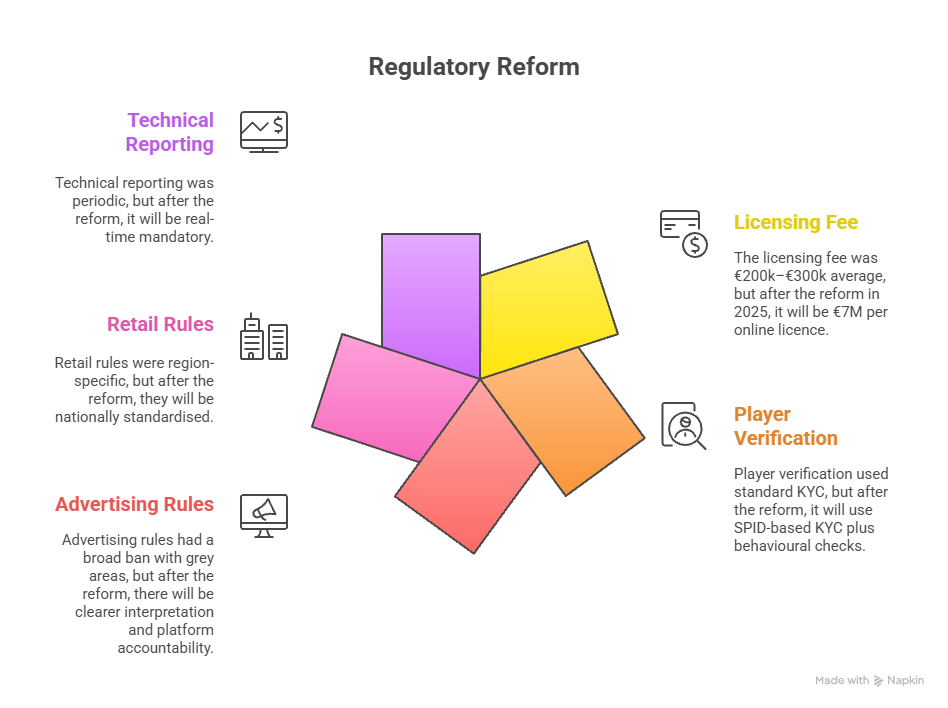

Table 1 , Overview of Italy’s 2025 Regulatory Adjustments

| Regulatory Area | Before Reform | After Reform (2025) |

|---|---|---|

| Licensing Fee | €200k–€300k average | €7M per online licence |

| Player Verification | Standard KYC | SPID-based KYC + behavioural checks |

| Advertising Rules | Broad ban with grey areas | Clearer interpretation + platform accountability |

| Retail Rules | Region-specific | Nationally standardised |

| Technical Reporting | Periodic | Real-time mandatory |

Comment: These changes push Italy toward a more centralised and technologically mature regulatory model.

How Operators Are Responding

A Market Moving Toward Consolidation

The steep cost of concessions is pushing smaller operators either to leave the sector or seek mergers. Bigger groups, especially those already embedded in Italy, are coping better thanks to established compliance capacity.

Brands regularly mentioned in Italian betting discussions include Marathonbet, which often appears in feature comparisons of bookmaker platforms.

Across the board, operators are upgrading infrastructure for SPID verification, AML screening, and faster reporting requirements.

Affiliate and Content Ecosystem Adjustments

Although promotional advertising remains tightly restricted, industry consensus suggests that only non promotional lists of Italian betting sites are acceptable, mainly within informational or comparison formats. This has shifted how publishers and affiliates structure content, rewarding clear, transparent editorial approaches instead of heavy promotion.

Impact on Bettors

Safer Environments and Stricter Controls

For players, the changes translate into:

- Tougher identity safeguards.

- More defined limits and automated risk warnings.

- A smaller space for unsafe or unlicensed platforms.

Leading Italian operators such as Quigioco have started rolling out stronger responsible-gaming features to meet ADM’s new standards. In the same way, established names like Planetwin365 are continuing to refine onboarding and verification flows under the tougher regime.

Some Transitional Friction

At least in the short term, bettors may notice:

- More frequent requests for documentation.

- Occasional delays while licences shift over.

- Less choice between brands due to consolidation.

Still, these drawbacks look temporary and linked to the market’s broader restructuring.

| Stakeholder | Benefits | Challenges |

|---|---|---|

| Players | Safer environments; better identity controls | More verification friction |

| Operators | More stable market; reduced competition | High compliance and licence costs |

| Regulator | Improved oversight; reduced illegal market | Increased monitoring workload |

| Affiliates | Clearer rules; stable expectations | Limited promotional options |

Comment: The reform redistributes responsibilities across the ecosystem, demanding higher standards from every actor involved.

A Note on Social Media Oversight

Online platforms, including X (formerly Twitter), are now monitored more closely following probes into indirect advertising breaches. A widely shared reaction to Italy’s new regulatory direction came from a European gambling commentator, underlining how much international attention the market is attracting. The post captures how closely observers are tracking Italy’s enforcement stance, especially around digital promotion.

Conclusion: A Cleaner, More Sustainable Future for Italian iGaming

The reform cycle from 2023 to 2025 marks one of Europe’s most substantial gambling-policy resets. The €7-million licensing requirement, SPID-enabled KYC adoption, tighter advertising interpretations, and heavier real-time reporting duties are all steering the industry toward a safer, more transparent future.

Operators are now expected to show strong financial backing, high technical compliance, and a real commitment to responsible gambling. Bettors gain stronger safeguards and a market with fewer risks, even if the transition brings some short-lived inconvenience.

Italy is clearly heading toward fewer licences, stricter controls, and deeper accountability. If this approach keeps evolving in the same direction, it could become a blueprint for other European frameworks down the line.