Navigating Online Gaming Licenses in LATAM

This article provides a comprehensive overview of the licensing landscape in Latin America, typical requirements, main license holders, and how the LATAM market’s evolution connects to global iGaming trends.

The Latin American (LATAM) region is rapidly emerging as one of the most dynamic markets for online gaming and betting, characterized by a patchwork of regulatory approaches, evolving licensing frameworks, and increasing international interest from operators in the UK and Canada.

Understanding the LATAM Regulatory Landscape

Online gaming regulation in LATAM is marked by diversity and fragmentation, with each country—and in some cases, regions or provinces within a country—designing its own system for licensing and oversight. Whereas some markets have moved toward structured compliance with robust licensing regimes, others remain in flux with ambiguous or highly restrictive policies.

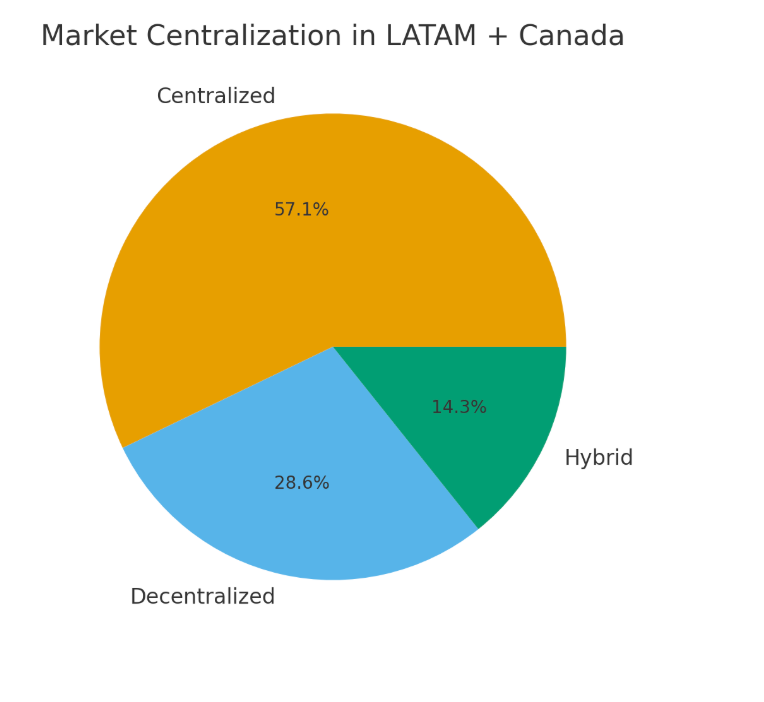

- Centralized vs. decentralized regulation: A key distinction in LATAM lies between countries with unified federal regulation and those operating through provincial authorities. In countries like Brazil, Colombia, and Peru, licensure is managed by federal bodies, often with strict entry requirements. In contrast, when exploring online betting in Argentina, the country delegates regulatory authority to its provinces, treating each as a micro-market with unique compliance measures. Operators must meet several key requirements, including partnering with local entities, proving strong data-protection practices, implementing responsible-gambling measures, and ensuring full financial transparency.

- Recent regulatory shifts: Several countries have introduced significant reforms in recent years. Brazil implemented Law No. 14,790 in January 2025, centralizing online casino regulation and ending reliance on offshore licenses. Peru, since late 2024, rolled out a detailed licensing and taxation scheme, and Colombia has led the way with comprehensive regulation since 2016.

These developments reflect a broader regional shift toward clarity, channelization, and consumer protection.

Market Centralization for LATAM and Canada, showing how the region’s major iGaming markets are structured.

Key Legal Requirements for Online Gaming Licenses

Getting an online gaming license in LATAM involves meeting standards that ensure market integrity, player protection, and technological robustness. While requirements vary by country, common elements include:

- Proof of financial stability: Applicants must demonstrate strong finances and transparent corporate structures.

- Responsible gaming protocols: Licensees must establish measures to prevent problem gambling, such as deposit limits and access to player exclusion programs.

- Technology compliance: Systems undergo independent audits to verify fairness, security, and anti-fraud standards (e.g., facial recognition for KYC in Brazil).

- AML and player verification: Strict anti-money laundering checks and player identity validation are required to prevent financial crime and underage gambling.

- Local partnerships: Some jurisdictions, notably Mexican online casinos, require foreign operators to partner with land-based facilities or local entities.

- Taxation: Operators face various tax models, which can include turnover-based or gross gaming revenue (GGR), and may change frequently with regulations.

Main Licensing Authorities

Each market’s regulatory structure is anchored by its licensing authorities. Key bodies include:

- Brazil: Federal government, since Law No. 14,790 (2025).

- Colombia: Coljuegos (Colombian Gambling Regulator), overseeing comprehensive online gambling regulation, the first of its kind in LATAM.

- Argentina: Provincial regulators, e.g., the Lotería de la Ciudad in Buenos Aires and the IPLyC in Buenos Aires Province.

- Peru: SUNAT, with recent reforms fostering market openness and tax clarity.

Authorised Operators: Market Leaders and License Holders

LATAM has seen the entry of both regional giants and internationally renowned brands. In Brazil, out of 114 federal license applications, 35 operators have been fully licensed, representing 173 brands as of early 2025. In Colombia, a mature market, the regulator has approved dozens of operators, including major firms from Europe and North America.

A growing trend is the partnership between UK- and Canada-based brands and LATAM operators to leverage local expertise and meet compliance needs. International operators, such as bet365, Betfred or Betsson often collaborate with local operators or acquire stakes in license holders, leveraging local market expertise and easing compliance burdens. This approach closely mirrors joint-venture practices seen in highly regulated markets such as the UK and Canada.

LATAM and Global iGaming Markets: Comparing Licensing Systems

The UK and Canada Context

Both the UK and Canada are leaders in iGaming regulation, with well-established systems that prioritize consumer protection, responsible gambling, and strict compliance checks. The convergence with LATAM markets is evident in:

- Adoption of responsible gambling frameworks: LATAM regulators are increasingly integrating responsible gambling protocols akin to those mandated by the UK Gambling Commission and Canadian authorities.

- Partnerships and technology transfer: International operators from the UK and Canada often bring technological solutions, market research, and compliance expertise to Latin American joint ventures.

- Channelization and consumer safety: Market maturity in both regions is measured by the level of channelization—steering customers toward licensed operators to reduce illegal gambling and improve consumer protection. LATAM is aiming for similar channelization levels through structured licensing and modern regulation.

Challenges and Opportunities

International investors and operators see vast opportunities in LATAM, driven by demographic trends (millions of mobile-first, young users) and regulatory liberalization. Nevertheless, challenges abound:

- Countries differ dramatically in licensing cost, process simplicity, and taxation approach. Brazil’s €5M license fee and stringent regulations contrast with more liberal entry in Costa Rica or Puerto Rico.

- Operators must adapt to frequent regulatory changes and political shifts that may affect market stability.

Despite these obstacles, many companies view LATAM as one of the most promising global iGaming frontiers.

Towards a Unified, Compliant LATAM Gaming Industry

LATAM’s iGaming sector is undergoing rapid transformation, with regulators increasingly adopting best practices inspired by the UK, Canada, and other mature markets. While regulatory fragmentation and complexity persist, the overall trend points toward greater harmonization, improved consumer protection, and more predictable paths to market entry.

While complexity and legal fragmentation endure, the overarching trend is toward harmonization, increased channelization, and reduced barriers for market entry.