Comparing Major ADM: Licensed Betting Operators in Italy: Who Offers What

Italy’s regulated betting scene has shifted a lot over the last few years, pushed by tougher rules, tighter licence criteria, and a steady merging of brands. Names like SNAI, Sisal, Lottomatica, Eurobet, Planetwin365, bet365 and Betfair now sit at the core of the ADM-licensed market. At the same time, newer or more niche operators, including casino-led platforms such as Starvegas and Admiralbet, operate under the same framework, even when sport isn’t their main priority.

Here we break down how this updated model functions, what the key operators actually provide, and where Italy stands compared with other regulated betting markets around the world.

The ADM Framework: A Quick Overview

From AAMS to ADM

Italy’s gambling industry is among the most heavily monitored in Europe. The move from AAMS to ADM (Agenzia delle Dogane e dei Monopoli) wasn’t just a rebrand, it was a step toward a clearer, more accountable system. ADM’s responsibilities include:

- granting and revoking online gaming licence

- enforcing AML (Anti-Money-Laundering) protocols

- auditing betting platforms, odds engines, and RNG integrity

- protecting users through mandatory safer-gambling measures

The 2025 Licensing Restructure: Fewer Operators, Higher Standards

A market moving from 400+ sites to 52 licences

In 2025, Italy rolled out a fresh online gaming tender aimed at simplifying and tightening the market. The headline results were:

- a new licence fee set at €7 million

- only 46 operators accepted across 52 licences

- ADM requiring one official domain per operator to cut down on player confusion

- stronger technical checks, KYC controls and AML rules in line with EU guidance

- Egba.eu shows Europe-wide compliance standards

- ANJ.fr provides transparency around French licensing

- UKGC outlines Britain’s regulatory model (learn more about UK responsible gambling)

Taken together, they point to a worldwide move toward stronger player protection rather than simply allowing more operators.

Advertising restrictions & player safety

Italy’s “Decreto Dignità” is famous for introducing an almost blanket ban on gambling advertising. Similar limits exist in Australia, where ACMA keeps close watch over betting ads.

On the financial-crime side, Italy’s AML focus fits with broader global approaches supported by UNODC.

The Major ADM-Licensed Operators Today

Italy’s betting market is led by a blend of long-standing domestic brands and global heavyweights.

Legacy giants with retail roots

- SNAI / Snaitech – extensive retail network, strong coverage of local sports

- Sisal – combines lotteries, retail payment services, and betting

- Lottomatica / Better / Goldbet – a family of brands built on major street presence

- Eurobet – well liked for football depth, promotions, and mobile-driven design

- Planetwin365 – sharp football pricing and a solid virtual sports range

The multi-brand setup around Goldbet highlights how operators split audiences: some users still want a shop counter nearby, while others bet almost entirely through apps.

International platforms operating with Italian licences

- bet365.it – global benchmark for in-play betting and live streaming*

- Betfair.it – sportsbook plus exchange DNA

- William Hill, LeoVegas, Betsson – internationally known names tailored to ADM standards

*Watch Live Sport. You can watch live sport on your mobile, tablet or desktop including Soccer, Tennis and Basketball. All you need is a funded account or to have placed a bet in the last 24 hours to qualify. Geo location and live streaming rules apply.

And among casino-first operators:

These lean heavily into slots and table games, but they still follow the same ADM rulebook as every other licence holder.

Comparing ADM Operators: What They Offer

Odds, Markets & Live Betting

Most ADM-regulated bookmakers cover a familiar core of products:

- football, basketball, tennis, volleyball and Formula 1

- broad live/in-play betting (“live”)

- cash-out on major markets

- combo and system betting options

- virtual sports

The biggest battle is in football. Brands like Planetwin365 and Eurobet often try to stand out there with boosted odds, special combos, or enhanced match markets.

User Experience, Apps & Payments

Top ADM operators now sit closer to international UX expectations, offering:

- quick, stable iOS/Android apps

- PayPal, cards, bank transfers and e-wallets

- retail top-ups and cash withdrawals for legacy names such as SNAI, Lottomatica and Sisal

- streaming for Serie A, tennis, NBA and more, depending on rights

Their focus on smoother mobile play and faster payouts mirrors what’s seen in other regulated markets such as:

- Ontario, regulated by iGaming Ontario (Canada)

- Malta, via the MGA licensing model

Snapshot of Key ADM Operators (Sports Focus)

| Operators | Strengths | Retail Presence | Typical User |

|---|---|---|---|

| SNAI | Italian sports depth, live betting | Very strong | Traditional bettors |

| Sisal | Lotteries + betting ecosystem | Strong | Cross-product players |

| Lottomatica | Football-heavy, multiple brands (Goldbet) | Strong | Football-focused |

| Eurobet | User-friendly app, combos, promos | Strong | Mobile-first |

| Planetwin365 | Strong football odds | Medium-strong | High-volume bettors |

| bet365.it | Best-in-class in-play + streaming | None | Live betting specialists |

| Betfair.it | Exchange roots | Limited | Value-seeking bettors |

Comment: Table reflects general positioning, not official ADM ranking.

Table 2 – Feature Comparison

| Operator | Live Betting | Streaming | Cash-Out | App Quality | Payments |

|---|---|---|---|---|---|

| SNAI | Strong | Yes | Yes | Solid | Cards, PayPal, shop |

| Lottomatica | Strong | Yes | Yes | Solid | Cards, bank |

| Eurobet | Strong | Good | Yes | Very good | Cards, PayPal |

| bet365.it | Excellent | Strong | Yes* | Very good | Cards, e-wallets |

| Betfair.it | Excellent | Good | Yes | Good | Cards, e-wallets |

Comment: Features vary over time; always verify directly on operator websites

*bet365’s Cash Out feature gives you more control over your bets and offers an opportunity to take a return before an event has finished. Terms and Conditions apply.

Choosing an ADM Operator: Practical Advice

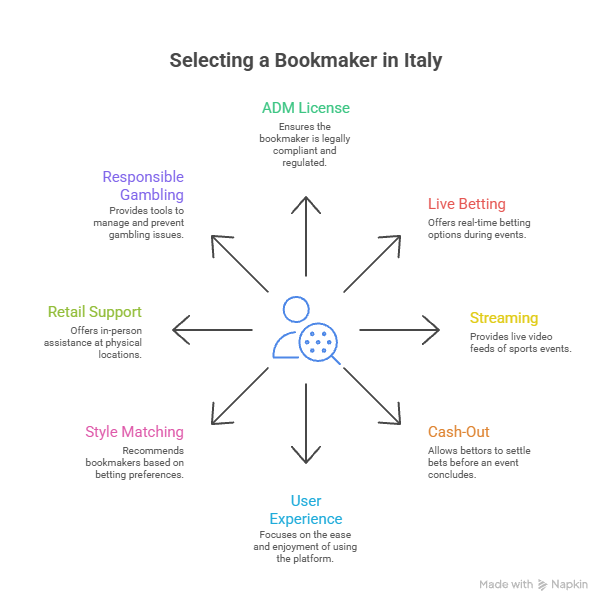

If you’re picking a bookmaker in Italy, a few basics help narrow it down:

- Make sure the platform is ADM-licensed

- Compare live betting depth, streaming access, cash-out options and overall usability

- Choose based on your habits (for example, live bettors often gravitate toward bet365 or Betfair)

- Think about whether you want retail backup, which SNAI, Lottomatica and Sisal still provide

- Pay attention to responsible-gambling controls and support tools

To compare all leading options, you can consult a curated list of betting sites in Italy.

Conclusion: A More Selective but Stronger Market

Italy’s ADM-licensed betting ecosystem is heading toward a clear shape:

- fewer operators overall, but higher standards

- closer alignment with global regulatory best practices

- a safer environment for bettors because of tougher AML, KYC and safer-gambling policies

- more competition on product quality, odds depth and user experiences

As other markets, Canada (Ontario), France, Brazil, Chile shift in the same direction, Italy sits firmly inside a broader global trend: regulated betting systems that emphasise transparency, player safety, and responsible, well-controlled innovation.