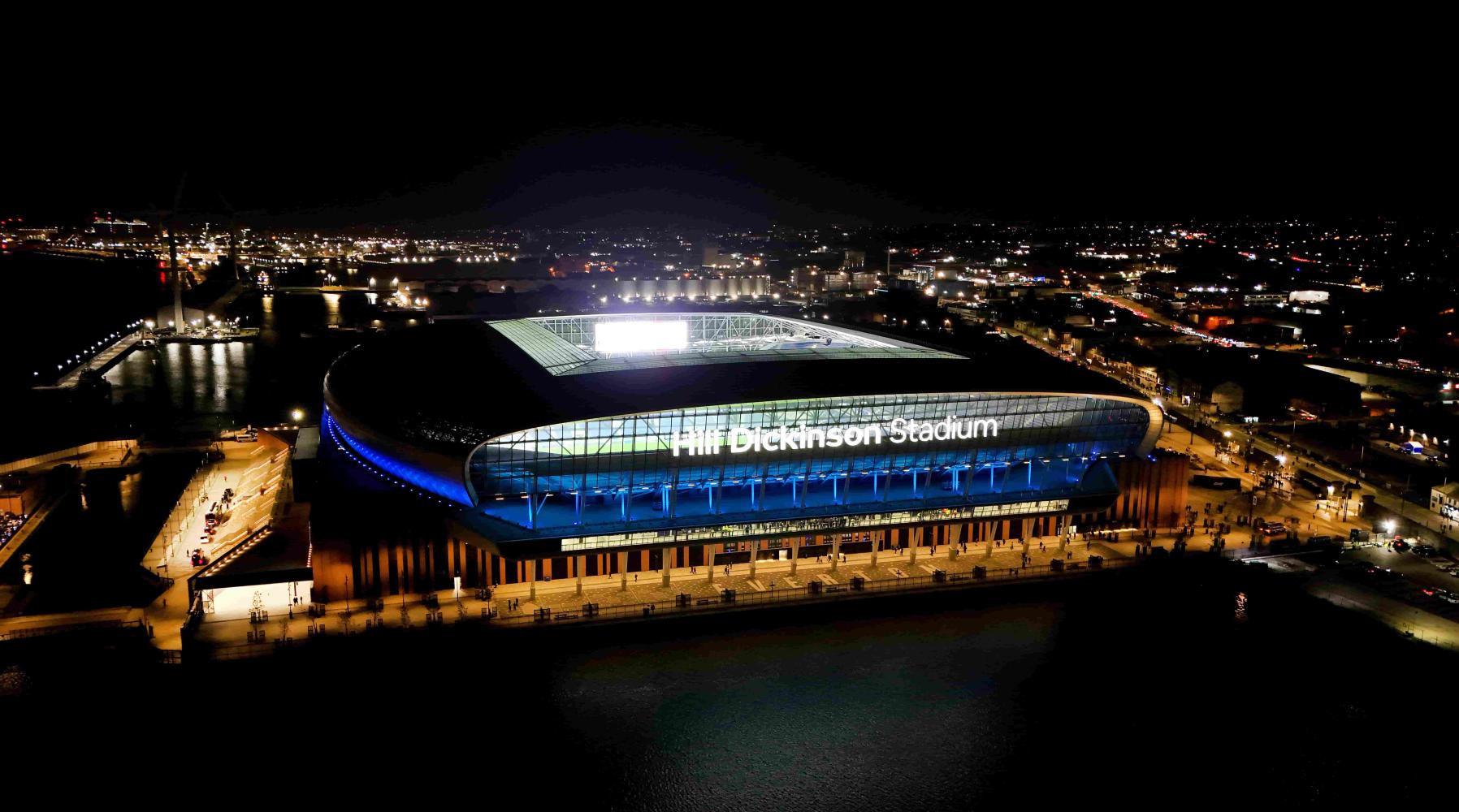

The multiple factors which led to the near financial collapse of Everton Football Club, including the huge debt burden, loans from non-prime lenders, failed takeovers and lending from 777/A-CAP combined with the huge, inflated cost of building and funding Bramley-Moore and poor on-the-pitch performance could not, even with the best will in the world, occur without significant damage to Everton’s competitiveness, its PSR position, Moshiri’s wealth, huge interest costs incurred by the club, and yes, consequences for the minority shareholders of Everton, those that hold a tiny 7,969 shares (0.5%) of the 1,621,287 shares in issue.

The remaining shares, totalling 99.5%, are owned by the Friedkins, through their acquisition vehicle, Roundhouse Capital. In the course of the takeover and financial restructuring, Everton issued 150,250 new shares at a non-cash value £3,000 each to convert Moshiri’s loans of £450.75 million and a further 1,336,537 shares at £174.66 to fund the repayment of loans and provide working capital.

The vast majority of the minority holders own Everton shares for emotional or family reasons rather than as an investment. That in itself is fine, it is well documented that almost all holders have no desire to sell their shareholdings which are often just one, two or a single-digit number of shares.

What is not so well documented, or had even been discussed (other than the question being asked on this site several times) is what impact the financial restructuring would have on minority shareholders.

Let me be absolutely clear, that this is not a dig at the Friedkins. It was obvious and backed by numerous examples of takeovers of failing businesses that the existing shareholders pay the price for the mistakes of the previous management. And this is the case here.

However, what is unusual, and worthy of comment at least, by our new owners, the Friedkins, is the situation that allowed shares in Everton Football Club to be traded at nearly twenty times the price the Friedkins paid for their newly issued shares, just a few days before the takeover was completed. Again, just for clarity, the issue of the new shares was absolutely necessary and the share price paid by the Friedkins created a recapitalisation at a reasonable, fair value, in my opinion.

Buying and selling Everton shares

As most will know, Everton Football Club Company Limited is a private limited company. It is not a quoted company (ie its shares are not traded on a recognised stock exchange) such as, for example, Manchester United.

Historically, Everton shares have been bought and sold on a matched bargain basis, through Liverpool-based stockbrokers, Blankstone Sington.

In common with several other non-quoted football clubs, Everton moved to a service called Asset Match who receive a commission for bringing buyers and sellers together via an online auction. The service is administered through the stockbrokers Albert E Sharp.

What does this mean? It means that buyers of shares bid for shares at a certain price, and sellers offer shares at a certain price and a deal is done when the two match over a defined period. Asset Match’s website can be found here.

All deals are subject to the approval of Everton’s directors (as per Everton’s Everton Articles of Association, Article 6.2) which gives the directors absolute discretion to approve a transfer of shares.

The three auctions since 12 October 2023 have produced the following results:

| Date | Shares traded | Price | Auction Details |

| 12 October 2023 | 42 | £3,700 | Everton – Auction Result |

| 1 August 2024 | 101 | £3,500 | Everton – Auction Result |

| 29 November 2024 | 72 | £3,400 | Everton – Auction Result |

It is important to note that the last completed auction, completed on 29 November 2024 was completed before the conclusion of the Friedkin takeover. The terms of the takeover were communicated with shareholders by letter on 18 December 2024 (details here).

On 23 January 2025, Matt Lawton, Chief Sports Correspondent of the Times wrote an article (here). In the article, he included the concerns as expressed by a buyer of circa 60 shares in the last auction concluded on 29 November 2024. The article also expressed the concerns of the Everton Shareholders Association.

Concerns

The concerns centre on the fact that the board of Everton under Moshiri (Farhad Moshiri, Colin Chong, Katie Charles, and John Spellman) permitted a public auction of shares to be held when it might be reasonably argued that they had knowledge of, or a reasonable expectation of a significantly dilutive share issue in the very near future, Based on the share prices achieved at previous auctions it might not be unreasonable to assume a similar price in the November auction.

Thus the new owners, the Friedkins, and the new directors of Everton Football Club have a tricky issue to resolve, although again it should be stressed the Friedkins had not acquired ownership of Everton at the time of the auction.

Wider concerns re the role of minority shareholders

With the minority shareholders (including the former Chairman’s estate) now only owning collectively 0.5% of Everton Football Club, a wider issue with regards to their future role needs to be addressed by the Friedkins.

It is clear as minority holders within a private limited company, the individual and collective rights are extremely limited. However, nonetheless, shareholders still retain some rights including the right to vote, receive company accounts and have access to certain information – for example the right to inspect director’s service contracts.

As a football club one can argue, and must argue that any prudent majority owner would recognise that there is an expectation of minority shareholder rights’ that go beyond the minimum rights granted via statute.

This is an issue that I believe the Everton Shareholder Association are about to address with the club in the coming days.

Handle with care

What exactly can be resolved with regards to the results of the auction is much more difficult to ascertain. Whilst the most recent buyers will feel hugely aggrieved with the outcome and the likely highly dilutive effect on the share price of the takeover and recapitalisation, the sellers will argue that the concept of buyer beware – “caveat emptor” – and the fact they sold in good faith must have some bearing.

It is an unfortunate issue for the Friedkins to inherit. Instinctively, it feels that doing nothing is not a viable solution (even if strictly it appears a legal option). It needs handling with care.

Reader Comments (26)

Note: the following content is not moderated or vetted by the site owners at the time of submission. Comments are the responsibility of the poster. Disclaimer ()

2 Posted 25/01/2025 at 07:25:56

The Estate's 'loss' (pedantically; you don't 'make' a loss, you can't make a negative, you 'sustain' a loss), while being substantial to the likes of us... well me, is likely only annoying to 'The Estate' when seen in relation to the aforementioned £40M+, along the lines of... again allegedly... "That twat Moshiri, he couldn't run a fuckin raffle."

Suffice to say, we're not likely to see any beneficiaries of 'The Estate' on a street corner selling The Big Issue any time soon.

3 Posted 25/01/2025 at 09:13:23

From my records, Kenwright sold 4,550 shares to Moshiri in 2016, at a reported price of £5k per share. That's £22.75M.

Followed by another 2,506 shares in 2018, reputed to be at the same £5k price, so that's another £12.53M.

£22.75M + £12.53M = £35.28M

If you add in the runt 1,750 shares still presumably in the Kenwright estate, that would have taken the total over £40M.

4 Posted 25/01/2025 at 09:27:50

The first part seems reasonable even though it undercuts the last share auction price by an understandable 12% or so, given the circumstances. The 150,250 new shares at £3k make complete sense for converting Moshiri's £450.75M shareholder loans into equity, which had to be done by 11 January.

It's the second part that bugs me. That incredible issue of 1,336,537 new shares, but only at that pathetic price of £174.66, to presumably match the £230M injected by TFG to recapitalise the club.

Why could they not stick with that established share value of £3k, and issue the corresponding number of new shares (77,813) for a similar amount (£233.44M) coming in to fund the repayment of other loans and provide working capital?

This would have left TFG owning a massive and totally dominant 97.8% stake (instead of 99.5%), diluting the minor shareholders’ collective stake to 2.2% rather than 0.5%?

Yes, it would nominally value the club at over £1B… which might seem high… although not really when you figure in the cost (value?) of the new stadium.

The minority shareholders have been well and truly shafted — on paper at least.

5 Posted 25/01/2025 at 10:01:44

"Because they can" seems to apply.

6 Posted 25/01/2025 at 10:13:05

Those of us who own a share or shares have an interest in this but I rather doubt many other Evertonians do.

Shareholders have lost the 5% discount they previously had for season tickets in the new stadium. There are very few benefits left for owning shares.

My best guess is, if TFG decide to buy the remaining shares, then this process means that every share will only be worth £174. EFC is a private limited company and TFG can do whatever they want.

Paul is alluding to TFG doing the right thing in his article, unfortunately the very expensive lawyers and accountants who have set this up may only be thinking what is in the best interests of their client.

7 Posted 25/01/2025 at 13:44:07

8 Posted 25/01/2025 at 13:53:08

9 Posted 25/01/2025 at 21:57:58

10 Posted 26/01/2025 at 06:32:47

11 Posted 26/01/2025 at 06:49:26

Right now, 1 share... out of many… might have a nominal value of £174 but is essentially worthless in the grand scheme of things and only worth what somebody would pay for the engraved paper novelty.

12 Posted 26/01/2025 at 06:51:25

I just don't think anyone who's paid £3,400 - £3,700 would be interested in selling at £174.

13 Posted 26/01/2025 at 07:01:04

Why did it need to be 1.3 million share for £174. Couldn't they have done much less shares each one being valued at a higher price to match the price of those created to pay off Moshiri's loans. Would that not have led to the same outcome?

Is there some accounting reason why they chose what they did?

14 Posted 26/01/2025 at 07:35:51

There's nothing like a real time practical demonstration of a...to me... piece of obtuse theoretical accounting - you live and learn...eventually...sometimes.

You never know, those rump shares might slowly gain value as our fortunes improve.

Prior to the next sell on...and there will be one, the 'Other Fool' theory almost guarantees it, there maybe a very brief sellers market.

That said the notional value of the club must now be around £1Billion. Which puts the shares around £750ish per share. More or less what Bill bought in at so that £174 is looking a tad undervalued.... Mystic Degsy says "Stick."

15 Posted 26/01/2025 at 08:00:44

Why did it need to be 1.3 million shares for £174? Couldn't they have done much less shares, each one being valued at a higher price to match the price of those created to pay off Moshiri's loans? Would that not have led to the same outcome?

That's exactly the question. It seems to be such an arbitrary number. But its impact on the investment of the minority shareholders is catastrophic. Why do something like that?

Is there some accounting reason why they chose what they did?

I was hoping Paul Quinn would explain it to us. The only number it affects is the capitalized value of the club if you do the full multiple of share price times total number of shares.

Some financial 'experts' say that's not a meaningful way to value the club, but I've been doing that calculation during the last 30 years whenever there's a change, and the results have tracked pretty well with the perceived club value (eg, Deloitte) and the price paid for other comparable clubs.

As Derek says, "the notional value of the club must now be around £1Billion" – instead of the rather pathetically undervalued £283.26M – which that calculation now yields at £174.66 per share.

16 Posted 26/01/2025 at 09:09:24

17 Posted 26/01/2025 at 10:10:28

I think it's just a simple as the difference between 'a buying price' in a buyers market - Moshiri wanted out, thus as cheap as you can get away with, in this case the £283M / £174 per share.

Vs a potential selling price down the track in 'a sellers market' when somebody wants in, which could see those 1,300,000 shares suddenly be 'worth' £1000 each / £1.3 Billion...or more.*

*Which in this day and age for a (soon to be) up and coming Premier League Club with a big fanbase and a new ground, not too excessive

TFG are not in this for the pure blue glory of EFC, that's just a nice bonus for the fans and it does no harm to the final sale price.

18 Posted 26/01/2025 at 12:24:51

That could set some type of precedent but I cannot see how TFG have any responsibility for any other trading done in the past.

19 Posted 27/01/2025 at 16:18:17

20 Posted 28/01/2025 at 23:13:11

It didn’t take too long to conclude that, in purely investment terms, a share wasn’t worth anything greater than £250.

If someone wants to pay more for emotional or sentimental reasons then of course that’s fine. But they can’t then call foul.

By the way the £174 number is derived by dividing the value of the company (which was in its knees) by the existing shares in issue. Why should anyone pay any more?

Sorry Paul Quinn but your article was aimed at stirring up emotion but has misled from the corporate reality.

21 Posted 29/01/2025 at 20:28:10

This would be valued much more highly in my view than anything else.

The Friedkin Group would also do well to utilise the minority shareholders as a useful sounding board for any decisions, as well as the other supporter groups of course.

22 Posted 31/01/2025 at 20:52:37

23 Posted 01/02/2025 at 01:55:01

"If 'somebody'...lookin' at you TFG...wanted to earn some goodwill and tidy up their own share holding at the same time, they might;

Declare those 4500? (or however many there are) 'rump shares' 'Fan Legacy Shares' or some such none voting feel-good bollocks, maybe even throw in with some fancy engraved and numbered certificates - and let them float in their own little market.

Or even test the market by issuing more of said none voting Fan Legacy (Legacy Fan?) Shares.

Then do an internal swap / rights issue thingy werein 1.3 Million shares become 1Million aka 100% of the Club.

Everyone's a winner, lovely jubberly etc.

Over to you TFG."

Allegedly as of now, the price as far as I can see is £174.66.

Seriously, right now to get the ball rolling, I hereby bid to buy 3 shares @ £185.00 per share...any takers?

24 Posted 01/02/2025 at 02:30:23

To answer Michael's comments.

The Friedkins have restructured Everton's finances that maximises their ownership of Everton whilst retaining Everton fans legacy minority holdings.

Inevitably when as a result of previous management mistakes (I am being kind) minority holders get absolutely stuffed during such a restructure. That's not the fault of the Friedkins though, that's business.

Re the valuation. Let's say if we said Everton had an enterprise value of £800m then the equity would be worth £500m. That suggests a value of approximately £300 per share.

Issuing shares at £174.66 doesn't seem to unreasonable in those circumstances.

What is unreasonable is the previous board permitting an auction to occur so close to what was always going to be a massively diluting event.

Incidentally I have, in broad terms, offered an alternative structure in my latest article, available now on my own site and hopefully here in the near future.

25 Posted 01/02/2025 at 03:21:54

Surely if a group of shareholders want to get together and sell off their shared to willing buyers the board can do nothing about that?

26 Posted 01/02/2025 at 08:28:27

Add Your Comments

In order to post a comment, you need to be logged in as a registered user of the site.

Or Sign up as a ToffeeWeb Member — it's free, takes just a few minutes and will allow you to post your comments on articles and Talking Points submissions across the site.

How to get rid of these ads and support TW

1 Posted 25/01/2025 at 01:14:44

I don't believe that the buyers could have any recourse against the shareholders that put their single shares up for auction.

The largest aggrieved party I would expect to be Chairman Bill's estate which has seen a massive dilution of value.