|

EVERTON FC: REFINANCING PACKAGE

|

|

EuroWeek Article, 30 January 2002 |

Everton has become the latest UK football club to

endorse the value of asset backed financing by

preparing a $75M private securitisation if its future

season-ticket receivables via Bear Stearns. Although

Bear has previously been involved in stadium financing

in the US, this is the bank�s first deal for a UK

football club.

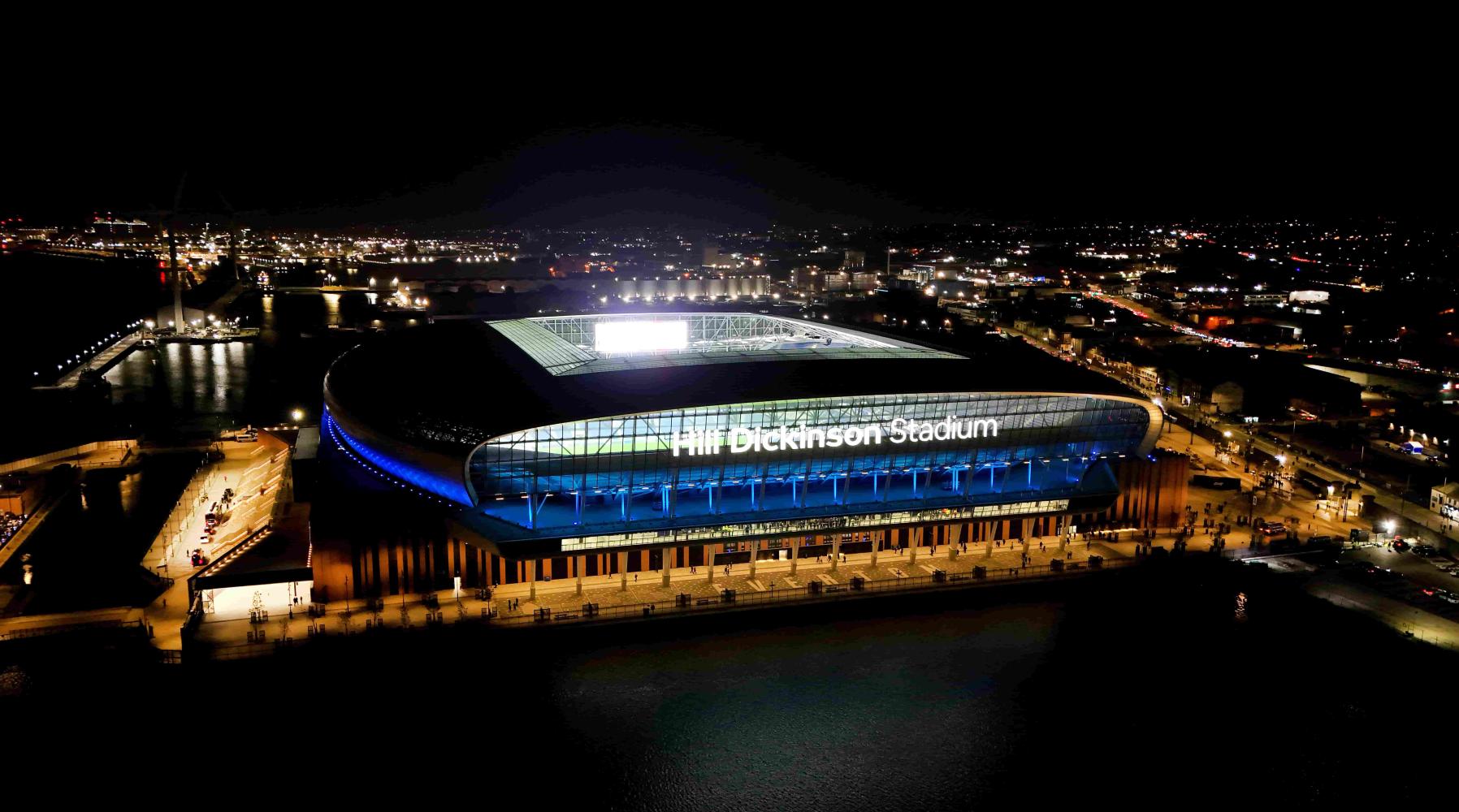

The offering is a 25-year fixed-rate deal shadow rated triple-B by Fitch. Funds raised will contribute to the club�s four-year debt-reduction plan. Proceeds could also help buy new players and play a role in the financing of a new 55,000-seat arena in the Kings Dock in Liverpool. The �155M multi-purpose arena is part of a �305M redevelopment including housing, retail and leisure facilities. Regeneration agency Liverpool Vision expects the arena to attract international concert promoters as well as being home to Everton. The full financing of the public private venture has not been finalized. Construction is expected to begin in spring 2003 with the arena due to open two years later. Football deals are typically bought privately by a small number of institutional investors. With this form of securitisation, investors are not relying on an existing pool of collateral, but on the club�s continuing ability to attract supporters. Everton is lying 12th in the Premiership and has reached the fifth round of the FA Cup. �As one of the largest clubs in the UK, Everton has an incredible history and a fantastic following, regularly pulling crowds of around 40,000.� Said Andy Clapham, senior managing director and head of principal and asset backed finance at Bear Stearns in London. �Even if it were relegated, supporters would be loyal and we expect the deal to go very well.� Investors in the US and Europe are being targeted and the transaction is expected to be launched in two or three weeks. Comments If this EuroWeek article is accurate then, with a BBB virtual rating and a 25-yr deal given current interest rates, the average annual debt plus interest repayments will be at about $6-6.5M per annum � if it is a flat rate repayment scheme ( as these things normally are). That translates to �4M per year that Everton will need to find from revenues (vs. about �1-1.5M interest costs last year). Repayments are normally made as one or two annual payments (capital plus interest) on fixed dates each year. Since the loan is secured against season ticket revenues only, Bear Stearns can get a court order forcing EFC to hand over the case in case of default but have no lien over other EFC assets. $75M will give Everton about �50M (after fees, and presumably in addition to the �12M long-term debt-restructuring facility announced previously), which can be expected to cover: which suggests that the refinancing deal will of their Kings Dock financing (�30M) as well as the overdraft replacement, player & academy / Bellefield funds we already knew about.

The inevitable sales of Nyarko and Gravesen, and other players in the future will obviously still provide the bulk of a relatively meagre transfer kitty. �50M over 25 yrs amounts to something less than 50% of annual season-ticket sales at current levels (even allowing for interest charges accrued on top), so the deal is NOT very highly leveraged. On a rough calculation at existing prices (including concessions for OAPs, students and unemployed), we'd need to sell around 10,000 season tickets each season to cover this loan. If you factor in the inevitable ticket-price inflation over the period, the burden in later years will be very low � no doubt providing scope for another refinancing plan if kings Dock proves to be a successful reality, and season-ticket sales increase accordingly. Overall, it makes a lot of financial sense. Comments based on discussion contributions from Neil Wolstenholme |