ToffeeWeb Comment

Everton Finances need a Shot in the Arm

by Dominic Lawson

The

Overdraft has now haunted the club for what seems like an eternity � a

constant menacing presence that ties our hands and prevents us progressing in

several vital areas.

The

Overdraft has now haunted the club for what seems like an eternity � a

constant menacing presence that ties our hands and prevents us progressing in

several vital areas.

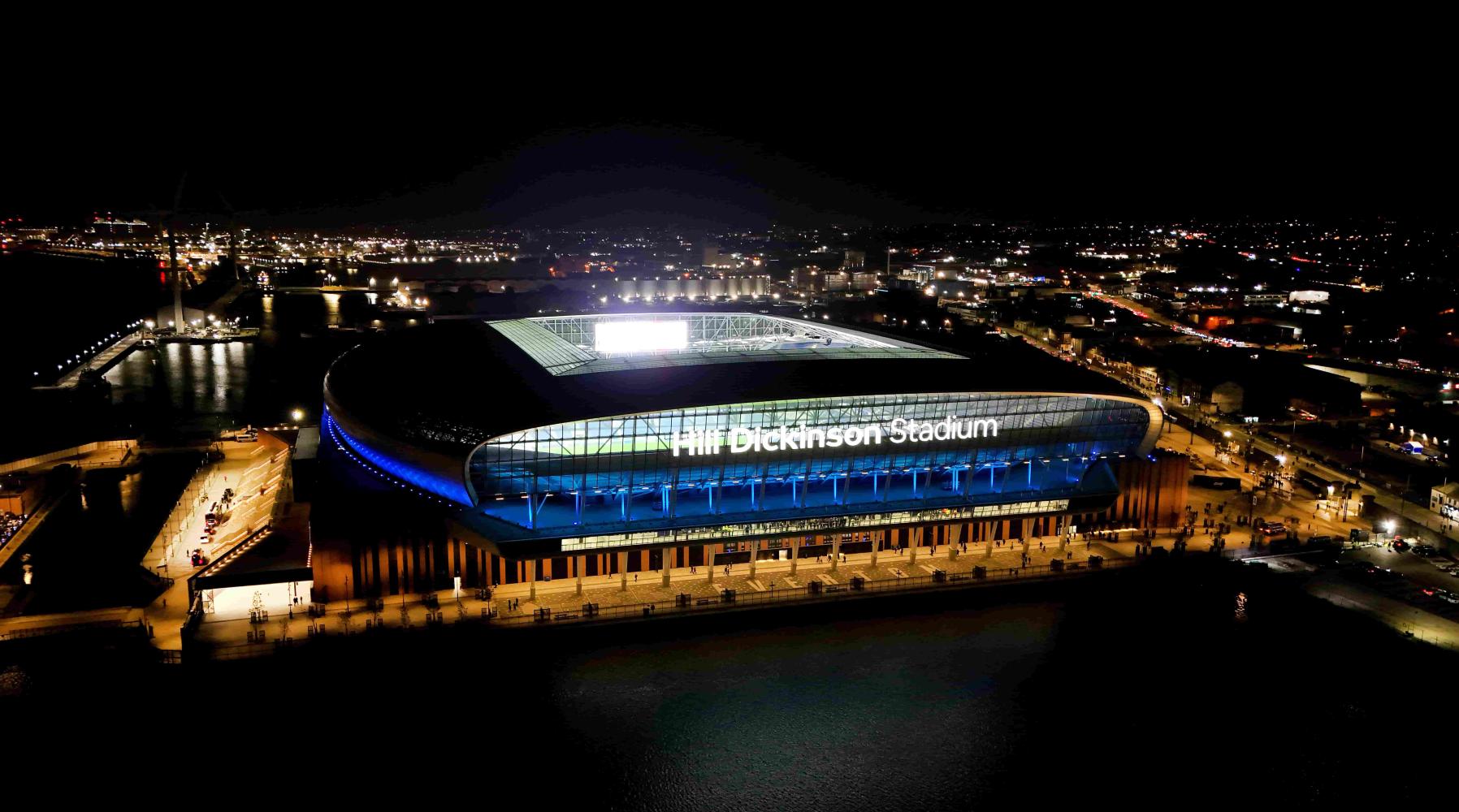

Institutional investors have now shied away from football and it's only the Man Utd's of this world that are of interest to them. The media deal went south, for whatever reason, and there seems little prospect of resurrecting it. The club now seems to be pinning all its hopes on the new stadium at Kings Dock.

Everton really have got their act together on this and have submitted a truly world class proposal that has the potential to open up large new revenue streams for the club. In the medium-term, this is exactly what the club needs. However, he phrase "all our eggs in one basket" springs to mind; until we gain preferred bidder status and get the stadium up and running, there are potentially a number of financially fraught seasons to negotiate.

Next season, the new Premiership TV deal kicks in and, by most estimates, clubs in the Premier League will see their TV income boosted to around �20M a season � potentially far more, depending on performance. We as a club should now be earmarking these new riches for squad strengthening and completion of the Youth Academy (a source of frustration for all Evertonians). Instead, the increased revenue will be used to pay down the burgeoning debt and to offset last summer's transfer activity. Other clubs will make giant strides on the back of this cash cow. Why not us ?

There is another way. Over the past few years, several clubs have appealed to their supporters for investment in the form of new share issues. The best-known case is Celtic and it is worth examining the circumstances that led up to the adoption of this financing instrument.

Celtic are a great club but, in March 1994, they lay in financial ruin with a moribund board of directors hanging on for grim death while the receivers circled... Celtic Park was a dilapidated ruin way behind the times and requiring large investment to bring it up to scratch. Cometh the hour, cometh the man � in the form of Fergus McCann, a self made Scots-Canadian business man and Celtic supporter. With the club minutes away from going under, he launched a rescue package that guaranteed the club's debts and allowed him to make the sweeping changes that put Celtic in the strong position they are in today.

One of the central planks of McCann's takeover was the launching of an issue of new shares, specifically aimed at Celtic's long suffering fan base (sound familiar?). It took place in January 1995 and raised �9.4M for the Club, creating 10,500 new shareholders in the process. The minimum subscription was set at �620 per unit (a unit represented five ordinary and five preference shares) and the issue was oversubscribed by some 1.8 times. At this point, Celtic was 40% owned by its own supporters. A key element of the issue was the availability of low cost loans from the Co-Op Bank which allowed supporters to borrow up to 80% of the cost of the shares.

Could this work at Everton? I believe it would, as evidenced by interest in the Everton Fans Trust prior to Bill Kenwright's takeover. Evertonians are some of the most loyal supporters in the game and would, I believe, jump at the chance of buying a stake in their club. But shares in Everton are currently so tightly held and so expensive that being a shareholder in our club is effectively impossible for many people.

There are many different ways this could be achieved with phased payment plans, low cost loans and a division of the club's shares into smaller, more affordable units. Given the chance to buy a share in the club for, say �250, with payment phased over twelve months, being a shareholder becomes an attractive proposition. There is the potential to at least match the amount raised at Celtic. Combine this with a rights issue to existing shareholders and the overdraft could at last be brought under control.

But before any of this can happen, one large obstacle must be overcome. The current board, and in particular the members of True Blue Holdings (Bill Kenwright, Paul Gregg, Arthur Abercromby and Jon Woods), must accept the fact that � for the good of the club � they must dilute their controlling stake. Between them, they currently hold about 70% of the shares in the club and, if they agreed to dilute this to 51% in the course of the new share issue, they would still retain overall control of the club if they so wished.

However, before investing in the club, many supporters would want to see at least the first signs of Everton adopting sound business practices by appointing a full-time executive team including a finance director and commercial director. Moves to provide more detail in the club's accounts to show breakdowns of merchandising and other commercial income would also be welcome.

So let's say goodbye to the overdraft and start investing in the future of the club. Sooner rather than later this issue must be addressed and the club must put a foot down on the ground and step off the financial roundabout that seems to be gathering pace.

Let's stop paying massive interest charges and having our debts trawled through the national press at every opportunity.

Come on Bill, you know it makes sense!

©2001 Dominic Lawson, 10 June 2001

Some Editorial Comments

The need for a share issue to the fans has never been greater, but the Board's continuing reluctance to entertain this obvious form of financial boost remains ominous. It would be at least illuminating to get some straight answers from Bill Kenwright on this important subject.

I'm not convinced an overdraft is necessarily the millstone Dominic makes ours out to be. Many businesses deliberately operate with a hefty overdraft as a cushion against uneven cashflow. This is ultimately a business decision. And the estimated �1M spent on interest charges (possibly offset against taxes?) pales into insignificance against the money lost on bad transfer deals (Nyarko, Hughes, Simonsen); excessive contract terms (Campbell); and injuries (the list is endless).

The real focus should perhaps be on why we continue to show poor overall financial performance, when many other clubs appear to operate a lot more efficiently with a smaller fanbase (although we have now slipped to 10th in terms of average gates!), and on a somewhat smaller total income.

Michael Kenrick

ToffeeWeb Editor