Analysis of the proposed 52,000 capacity for Bramley-Moore, including season ticket pricing

A focus on the business case and the impact a smaller stadium capacity has on ticket prices (particularly season tickets)

On 20 December 2018, Everton put forward a proposal (not a decision), subject to further consultation and planning approval, to design and build the new Bramley-Moore Dock stadium with an initial capacity of 52,000.

I've plenty of reasons to disagree with the proposal but, for the purposes of this article, I'll focus on the business case and the impact a smaller capacity has on ticket prices (particularly season tickets) in just ensuring we remain on par as far as match ay revenues are concerned, after financing costs.

The justification for this decision was cited by Colin Chong (Stadium Development Director) as “It is commercially and financially sustainable”.

The club also offered the potential for the capacity to rise to 62,000 although with the huge caveat: “It is not possible to say if and when any capacity expansion to an absolute maximum of 62,000 would take place”.

Therefore, from an analytical perspective, this is no more than a wish, an expression of what is theoretically possible... but, for those holding out the hope for a 62,000 capacity, let's be clear: there are no defined plans to do so. As such, it does, however, demonstrate that the site could accommodate 62,000 and that there would be reasonable confidence of a successful planning application at that level.

Thus, if the business case supports a capacity anywhere between the two limits (52,000 and 62,000), then the size of the Bramley-Moore plot and the likely response of planners should no longer be reasons not to achieve a higher capacity.

The business case:

In the simplest of terms, any business case for a capital investment looks at:

(i) The increase in demand required to meet the capacity of the new facility (be it a stadium, a form of transportation, or a manufacturing facility — the theory is identical);

(ii) The costs of building the facility, including the amount of capital required, the cost of that capital, and the ongoing maintenance of the asset, once built.

There are, of course, many other factors — not least including the macro-economic conditions and the competitive environment the business finds itself in, and how it must respond to maintain or improve its position relative to its peers.

The primary reason for any capital investment is ultimately to generate sufficient revenue to (i) meet the cost of the investment, and (ii) generate significant additional revenues for use by the business or shareholders as appropriate.

So, enough of the theory; let's look at some numbers, starting with the cost of the stadium and the capital required to build it:

Costs, capital required and likely costs of that capital

It appears to have become the accepted wisdom that building a stadium at Bramley-Moore Dock will cost north of £500 million. This seems an extra-ordinary figure for a 52,000 seat stadium but there are special circumstances relating to the location. The site and ground preparation costs are known to be expensive, given the nature of the existing dock and the heritage considerations on such a sensitive site.

It is thought that the preparation costs are in the region of £120 million, leaving £380+ million to build an iconic stadium housing 52,000 fans with the theoretical ability to expand to 62,000. That equates to more than £7,000 a seat which, I am told, is at the higher end of the scale for building football stadiums (especially as preparation costs are stripped out of this figure).

I am also told that building with an initial capacity of 60,000 or above places a disproportionate level of additional costs on the additional seats — more on that later, but I think that is a false argument when the benefit of a greater capacity is looked at in its entirety.

Using the £500 million figure, how much is likely to be borrowed and at what cost? Not being party to the discussions, it is impossible to give a precise figure but borrowings of at least £300 million should be expected. The cost of those borrowings are again confidential but an estimate of 5.25% should not be considered unreasonable.

The difference between what is borrowed and the final budgeted cost will be met by the shareholders (most likely just Farhad Moshiri), any contribution from naming rights or other commercial partnerships, and any contribution from the public purse given the infrastructure and regional development aspects of the stadium and the wider development. Therefore, Farhad Moshiri is looking at an additional £200 million investment — less any contributions from the sources mentioned.

Bearing in mind one of the primary reasons for building a new stadium is to increase the revenues available to the football team, it's worth considering the possible repayment costs. There are a range of values depending upon how much is borrowed and at what cost. I'll be using £300 million at 5.25% as a base case but will show other values also:

Annual repayment costs of £300 million loan at 5.25% over 25 years = £19.9 million. For every £25 million increase (decrease) the annual repayment increase (reduction) is approximately £1.66 million. An increase (decrease) in the agreed (and then usually fixed) interest rate of 1% increases (reduces) the annual payment by around £2.2 million a year.

So, going with the above calculations, I'm assuming capital and interest repayments of £19.9 million a year with the above variations if the quantum and costs are different.

Matchday revenues

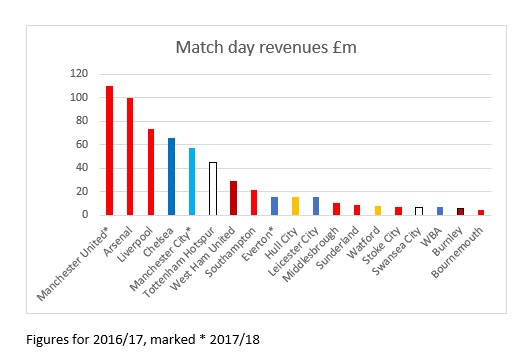

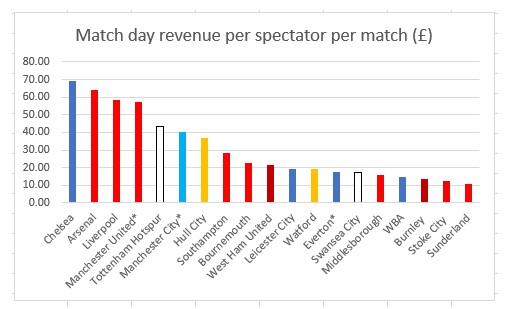

I constantly hear that matchday revenues are not important anymore because of the huge revenues from broadcasting. This is palpable nonsense. Non-broadcasting revenues (including matchday revenues) are the key differentiator between the largest clubs, middle-ranking clubs, and also-rans.

There are multiple factors for such a wide variation in matchday revenues from clubs competing in the same league. These include capacity, numbers and types of premium seating, numbers of season tickets, the pricing of season tickets, the pricing policy relating to different age categories (children, young adults, senior citizens etc), the price of walk-up tickets, and the competitive position of the club and location.

One of the interesting ways of comparing clubs' pricing policies is breaking down the overall matchday income into income per spectator per match:

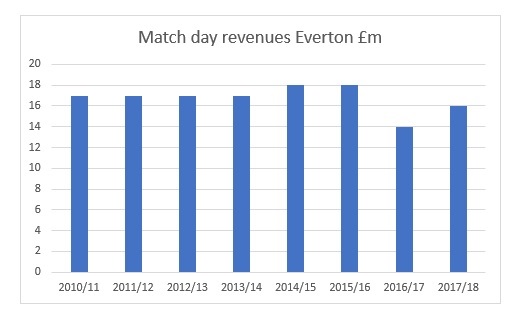

Everton have had an admirable policy of holding prices as low as possible (£17.64 (2017-18) per spectator per match versus Liverpool's £58.64 (2016-17) for example, arguing that having a full stadium and attracting a younger fan base is a justifiable business decision given the capacity and condition of Goodison Park. It is also a result of the very low level of premium or hospitality seating available at Goodison Park (less than 4% of capacity) and the maximum number of season tickets sold under Premier league regulations. This is something I largely support, but how realistic is it in a new stadium with debt to be serviced and increased revenue expectations attached?

The policy of not increasing prices, maximising season ticket sales and concessionary bandings mean there has been no increase in overall matchday income since before 2010-11. From the public comments made by the club, with the desire to keep tickets affordable, it seems unlikely that there will be a significant uplift in the figures of the last decade whilst remaining at Goodison. This will need addressing to make Bramley-Moore, in Colin Chong's words “commercially and financially sustainable”.

The requirement to increase net revenues from the new stadium

As expressed above, one of the key reasons for building a new stadium is to increase revenues available to the team.

From the above, it is clear that the 52,000 have to generate £38 million (debt costs plus current revenues) just to stand still. Using 19 Premier League games, that equates to revenues of £2,000,000 a game — just to stand still.

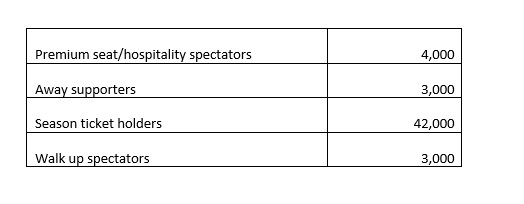

How is this possible? Well firstly we have to look at the breakdown of types of fans attending a 52,000 capacity. I'd model that it looks something like:

I'm going to suggest, as in previous models, premium seats generate £175 per head (ex VAT), Away supporters £25 (ex VAT), and walk-up supporters an average of £40 (ex VAT) per head. That leaves season ticket holders who constitute the bulk of the home support.

Based on that assumption, the average revenues required from a season ticket per match is £26.30, which is the equivalent £500 (bar 30p) for the entire season. For the season ticket holder, 20% VAT must be added to these prices, taking the average price of a season ticket to £600.

By way of comparison, I estimate the current average season ticket price to be in the region of £270 (inclusive).

Now that is the average price, meaning it includes children, young adults and senior citizens — all of whom currently pay significantly less (from £95 to £299) than the full adult price (from £420 up to £560). It also only generates enough cash to keep us in the same net position as we currently are at Goodison Park.

To get to the level Spurs were in 2016-17 (£40 million matchday revenues), for example, would require the 52,000 to contribute another £1.1 million a game, slightly more than another £21 (ex VAT) per home spectator.

Therefore it is clear that the capacity of 52,000, with a fairly low level (4,000) of premium seats, requires a significant increase in the price of season tickets across the board, including concessions, and a significant increase in walk-up ticket prices in order to generate reasonable cash levels over and above the debt service levels and the current revenues generated by Goodison Park.

In previous articles, I have modeled 60,000 as the ideal capacity at Bramley-Moore Dock. I appreciate entirely that that adds to the costs. It has been suggested to me that maybe as much as £80 million to the current budget for a 52,000 seater. I also understand entirely that the bulk (if not all) of that cost would come in the form of equity or other funding, not by a significant increase in debt.

However, the 60,000 capacity based on much bolder assumptions and expectations of demand would allow for a higher premium capacity; in my models, numbering 5,000.

The result would be a much smaller burden placed upon season ticket holders and walk-up ticket purchasers. In a 60,000-seat stadium, using the same model but with 5,000 premium seats sold each game, 42,000 season ticket holders would see their average season ticket price at £295 + VAT (£354 inclusive) as against £500 + VAT (£600 inclusive) in a 52,000 seat stadium.

That's a difference of £246 inclusive per season ticket when comparing the 60,000 capacity and the 52,000 proposal.

The argument put to me against a 60,000 capacity is either cost, demand or a combination of the two.

On cost, I acknowledge there's an additional capital cost, but I'd argue that's countered by the benefit of much smaller required increase in ticket prices to fund the debt and provide income for the footballing side of the business, and an increased likelihood of full-capacity attendances, leading to future increased revenues over time.

I'd argue that this greater initial affordability increases the likely demand for tickets, a demand which on many occasions I have provided reasonable arguments based on evidence to suggest 60,000 is entirely achievable.

I've often talked about risk. To me, the lower capacity proposal is the highest risk option for the club. Why? Because it places a huge pressure on extremely high ticket price increases, thereby reducing demand due to affordability issues. It would be entirely inconsistent with the approach in recent years, as demonstrated above.

A 60,000-seat stadium, on the other hand, with a higher capacity premium seating area, and greater availability of walk-up seating, would continue to make season tickets relatively affordable — at least much more so than the lower capacity proposal.

I will return to the demand argument, and how to generate demand, in my next article.

Conclusion

The cost of servicing the debt associated with a new stadium places an increased cost burden on fans just to enable the club to stand still with regards to matchday income after costs.

The smaller the capacity and number of premium seat holders, the greater the increased cost burden on season ticket and regular ticket purchasers (walk-ups).

In this model alone, the difference in cost for an average season ticket could be £246 per season ticket holder per season.

There is a compelling argument for demand for 60,000 initial capacity. That argument is strengthened by the additional affordability benefits of a larger capacity.

Sensible capital investments are about recognising the demand for an increase in capacity and ensuring that the income generated more than compensates for the cost of investment, all whilst not increasing the overall risks to the business.

From my perspective, and from the logic of this argument, that's best achieved at a higher initial capacity — not a lower one.

With respect to the club and the major shareholder, the 52,000 capacity proposal is not the correct solution to maximising the benefits of Bramley-Moore Dock, and on the basis of fan affordability, it is the higher risk strategy.

More to follow in coming weeks — including demand and rail seating (safe standing).

Thanks for reading.

Follow @theesk

Follow @theesk

Reader Comments (113)

Note: the following content is not moderated or vetted by the site owners at the time of submission. Comments are the responsibility of the poster. Disclaimer

2 Posted 30/12/2018 at 21:24:24

You argue that a larger capacity makes the cost-per-seat cheaper and thus less of a risk. This is assuming, of course, that we can regularly sell-out at the larger capacity. If we can only reasonably expect 52,000 spectators per match, the extra 8,000 seats you propose are surely just a financial deadweight?

Secondly, a lot of your analysis is done on estimated numbers. You obviously know your onions and with concrete figures, I'm sure your analysis would be spot on. I would, however, like to think that Everton have hired experts as qualified as yourself who are indeed working with the actual sums involved. To this point, they have identified a capacity of 52,000 as the sweet spot, at least from a financial perspective. If you were to rejig your numbers in such a way that you reach the same conclusion, what would those initial numbers have to be?

My final point is that I'm unsure that it's simply a matter of capital investment. Surely adding an extra 8,000 seats has a significant knock-on effect on operating expenditure which must be taken into account? Perhaps above 52,000, the added expenditure grows exponentially as the site reaches its maximum capacity.

Thank you very much for your well-written and thoughtful analysis.

3 Posted 30/12/2018 at 21:44:46

There's one thing that concerns me and that's the level of (latent) demand. The New Year's Day game vs Leicester still isn't sold out (according to the EFC website), though tickets have been on general sale since 7th December. If we can't sell out at 39,000, or only just sell out (witness other home games selling out only close to the game itself), then is 62,000 really a goer?

4 Posted 30/12/2018 at 21:50:21

5 Posted 30/12/2018 at 21:54:58

6 Posted 30/12/2018 at 21:59:39

7 Posted 30/12/2018 at 22:03:32

8 Posted 30/12/2018 at 22:20:39

My 5-year-old daughter has said she's coming with me, so I'm looking forward to that, although it probably means I will be out the stadium by half-time though.

She keeps telling me she's going to Wembley on the fast-train, so I hope she brings us some luck, unlike my other two jinxes, who've seen us win nothing. This will hopefully change soon, especially because I'm watching the magnificent Coldplay, singing “Fix You†on the telly right now, and the lyrics just seem so apt!!

9 Posted 30/12/2018 at 22:39:02

If I was not already a season ticket holder there is no way I would buy one with an obstructed view. I would also think twice about buying one of those seats as a one-off, for example, against Cardiff, Bournemouth etc. I thought the purchase of season tickets should have been included in the fan consultation and surely contacting those on the reserve list would have been a good idea.

Hopefully the proposed 52,000 capacity is simply a starting point which will rise once the next consultation has taken place.

10 Posted 30/12/2018 at 22:42:46

Playing for Bolton, Reid broke his leg, one of our lads stroked the ball 'home' to see it stop on the line in the snow. Match abandoned at half time. We were even more disgruntled as there were no refunds. Hope this new year is better all round!

11 Posted 30/12/2018 at 23:46:36

As has been mentioned, the club will have hired experts who are privy to all of the relevant facts and numbers. Moshiri may have made some footballing mistakes, but he is clearly a smart man, and I trust the club to have carried out their due diligence. Nobody could suggest that the club are rushing into any rash decisions.

There is an awful lot of thought and consultation going into this project and a final decision has yet to be made. I have confidence that the people involved will have more knowledge and expertise than those analysing pros and cons without the full facts.

12 Posted 31/12/2018 at 01:10:13

Gary Corgan (#2) raises the obvious question which I am sure Colin Chong has had to answer to the board – how many people can we expect on an ongoing basis per game in a new stadium?

From 40,000 to 52,000 = a 30% increase in attendance. To 60,000 is a 50% increase in attendance.

I will wait for your next article about this subject before I make my mind up but, at this stage, I am going to take some convincing that 60,000 on a regular basis is achievable.

On the site preparation costs, 𧴰 million seems an awful lot of money to me. Does anyone know if this is to drain and fill the dock? Has this question been raised at the consultative meetings?

13 Posted 31/12/2018 at 01:50:29

Kenwright epitomises greed, hypocrisy and prevarication; just why Moshiri still chooses to endure him in the boardroom is a major worry to me in advancing the club to mere contender status, never mind actually winning anything.

14 Posted 30/12/2018 at 01:54:12

I went down to Brighton and used one of their three, free, park and ride facilities. One is at Brighton Racecourse, another is at the university and my one was one side of a blocked-off country road. The buses drop people off at various points nearest to where they are parked. As the buses are free they load up very quickly and I was back at my car by 5:20 pm. It was really efficient.

I believe it was part of the planning conditions for their stadium and is funded by a small addition to all ticket prices so an extra cost, albeit small, to the fan rather than the club. For those using the buses, it's obviously well worth it and it keeps cars away from the immediate surrounds of the stadium, thus reducing congestion and pollution.

It may well be that similar conditions will be applied to the Bramley-Moore Dock planning process and it would certainly ease fears expressed about dispersing large numbers of people in a short time. (Although no such conditions were applied to Liverpool's stand extension application.)

I currently spend zilch at Goodison but, like Ralph #1, I would probably be tempted by a good offer with decent facilities. I think this area is a very underestimated potential revenue earner across the board from club shops, restaurants, fast food and bars.

More footfall = more potential spend. A good offer results (in retail terminology) in a bigger basket spend. The potential is enormous.

15 Posted 31/12/2018 at 04:22:24

And it's really, really easy for an American, 4133 miles away from Liverpool, to say. **Gulp, here goes**

We need to raise ticket prices.

There's too much money not being realized. This is professional sports. Over here, I'd never expect to get into a professional game of any type for under $50 (approx. 㿓).

We need a ring of corporate boxes, and ticket prices should be at least 㿊.

I'll put on that tin hat thingy, but we're not charging enough and we're forgoing entirely too much revenue. If you can rob Peter to pay Paul through corporate boxes, and keep the average ticket price at 㾾 for the "rank and file", fine. But we're leaving too much money on the table.

It's a business.

16 Posted 31/12/2018 at 05:45:47

If not why not increase the premium ticket capacity to 5,000 on the 52k stadium?

17 Posted 31/12/2018 at 08:27:09

#2 Gary – agree my figures are predicated on achieving capacity, I've argued strongly and produced evidence based on other clubs the likelihood of getting to 60k. The club will have more detailed figures than myself for sure. But the principle that a smaller capacity will require higher ticket prices stands – that is the real point of the article.

#3 Brent, I'd counter that it is remarkable that we are within a few heavily obstructed seats of selling out. I think the seats offered on general sale are chalk and cheese when compared with the view and facilities offered in a new stadium.

#11 Chris see my points above, appreciate your comments though.

#13 Don, I think we still have huge issues across the board and the senior executive team. We lack the talent, experience and drive of many of our peer's management teams.

#16 Drew, there's no regulatory limit on premium seats, the figures are driven by design limitations and the view of the club in terms of what demand will be. I believe the club is being too cautious in going for 4k. At 7.7% of the total capacity that is lower than all of the major clubs. Given that premium seating is the key driver for revenue growth, I believe we need to be more aggressive and positive on the number of premium seats offered.

Thanks for everyone else's comments.

18 Posted 31/12/2018 at 08:35:20

19 Posted 31/12/2018 at 08:40:06

I think premium seats of 4,000 will likely be many more – probably 5,000 and also 60,000 is not financially viable as it will cost circa 㿼m and we don't have the demand year on year, game and game.

21 Posted 31/12/2018 at 09:43:07

Interesting but as Everton will have to reach those with more money to make this work I would put more emphasis on premium seating and a range of offerings – no doubt what the club have spent the last year discussing.

Nonetheless, 㿔 per seat average will have to be the starting point – more for premium matches. And there lies the rub – we need to be putting on more premium matches ie European footy.

22 Posted 31/12/2018 at 09:49:53

If we can become a top-four side, pushing for the title, winning a Cup or two along the way, getting into the Champions League etc, then in turn we can fill a 52,000 capacity stadium. But if we continue meandering between 7th and 12th each season, even 40,000 will be a push.

A new stadium is probably a few years down the line, so would be great to have a successful team to move into it by then. I hope Marco is the man to do it.

23 Posted 31/12/2018 at 10:02:10

Absolutely priceless somebody who doesn't contribute anything to matchday revenues suggesting those of us who do should pay more.

I know we have a lot of contributors from far afield who believe they are Everton fans but, in reality, they aren't. There is only one definition of a fan — that is somebody who goes the game and vocally supports his football team. Not someone who sits in front of a screen for 90 minutes then pontificates to tell guys who have been the game that we need to pay more to make the club successful.

I will now put my tin helmet on for all our overseas bystanders to have their say.

24 Posted 31/12/2018 at 10:21:10

Jamie, perhaps you should take a tour around some of the streets around Goodison and take a guess at the average wages earnt in the area.

However, Brian, many of us pay Sky or BT for football which gives the clubs the majority of their revenue. The same can be said for fans in the US and elsewhere, whose TV stations have paid for access (all part of the revenue stream).

Some of us only get to a few live games a season, for all sorts of reasons, financial, geographical, time etc, but I would defend all of these people as being "fans".

Going back to prices, I hope that a range of deals can be offered to encourage all to attend. Much like the club do now.

25 Posted 31/12/2018 at 10:25:16

A 'fan' is someone who admires and supports a team. You don't have to be in the stadium to do that.

Quite clearly, judging by the amount of passionate posts that Jamie writes daily, he is a huge 'fan'! He can't help having an ocean between himself and his beloved adopted club.

26 Posted 31/12/2018 at 10:27:01

I don't know about others, but I am expecting a stadium where it is easy to get a decent pint (and something to eat if needs be) in relative comfort and importantly speed. Along with a few others who have posted, I would estimate I spend less than ٣ inside Goodison Park per season (I am a season ticket holder). I always arrive dead on the kick-off.

Speaking personally here but, if the question is would I spend a couple of hundred pounds more on a season ticket at the Bramley-Moore Dock stadium which would enable me to spend 㿀 or so before, during and (importantly) after each game, the answer for me is an emphatic YES.

I think 52,000 is a bit stingy. I think the club knows this and has left themselves a bit of wriggle room. Expect about 55,000 when plans are announced. That's just my guess, by the way.

27 Posted 31/12/2018 at 10:41:50

28 Posted 31/12/2018 at 10:42:11

My brother and I wanted to take a client each to a game this season and ended up having to book an away game at Man City for about 𧶲 per head. Great day and facilities. Loads of people I know would do this on an ad hoc basis for birthdays and specials, you don't have to commit to the whole season in premium seats.

29 Posted 31/12/2018 at 11:01:44

In which case, might they be prepared to, initially at least, forego what would otherwise be seen as a full return on their investment?

30 Posted 31/12/2018 at 11:07:47

Thanks for the article. Especially trying to nail down some meaningful figures given the obvious lack of clear information regarding Bramley-Moore Dock.

Of course in doing so, you have to make some rather broadbrush assumptions in order to start creating those comparisons, and that is where the arguments can become quite fuzzy.

I agree, that 𧺬m seems to be quite an exorbitant cost for a relatively simple 52k stadium. This figure appeared out of thin air a while ago, and I think many thought like me, that this was merely a prelude to our traditional announcement of another failed stadium project. It's very difficult to analyse such a headline figure without a breakdown.

Again, 𧴰m prep costs appeared from nowhere and also seem excessive, as I believe neighbouring docks were infilled at a fraction of that. So, all-in-all, you're trying to read between some very sparsely and dubiously populated lines, and I don't think it will be very difficult for the club to counter by shifting a few parameters to completely unbalance your equation.

They will no doubt argue that going from 52k to 62k will represent a far greater and disproportionate cost increase. Some general industry rule of thumb pointers can indicate that total construction costs can almost double for every 10k increase above 40-45k. Indeed, Meis has already intimated such previously. Of course, that is very much dependent on the quality and format of the design, and can be mitigated against.

I also, think that the club could just as easily state a premium seat capacity of >5k even in a 52k stadium... even higher if they broaden their offer in this category. Boxes convertible to hotel rooms, and lounges to conference suites etc can all offset this further, but of course apply to both capacity scenarios. I am also slightly surprised that there aren't some economies to be gained from construction into an already excavated site, limiting the cost due to height but haven't looked at the dimensions tbh.

However, as a comparison, Feynoord are currently looking at < 𧸖m construction costs for a new 63k waterfront stadium. Only 6 years ago, Lille produced a 50k stadium for <€300m, with the added complexity and expense of both a moving roof and pitch.

Personally, I thought the whole idea of moving was to increase revenue streams by tapping into multi-all-year-use and markets at a more central and prestigious location. As stated, there is the obvious uplift due to the grossly inadequate lack of corporate at Goodison Park, but the lack of a closing (or full) roof at Bramley-Moore Dock hardly differentiates us from what's on offer at Anfield who are already making pre-emptive inroads into that market.

One problem is: potential for matchday increases from general admission seats would appear fairly limited due to only just filling 39k at rock bottom prices. Yes, the obstructed view issue may deter some at present, but the biggest driver will always be the size of our match-going fanbase. The club will have all the data on this, and it would appear that the "experts" have pointed to the lower figure as their "sweet spot". Limiting their capital expenditure, while optimising revenue by controlling supply you might say a less miserly application of the "Juventus approach".

At the start of your analysis you highlighted the fundamentals of the decision process, and that is where we are at in the absence of anything solid. As you'd probably expect, I would suggest that it would be far easier to demonstrate that a much lower expenditure on redeveloping Goodison Park could yield 52-62k with exactly the same mix of premium, club, and general-admission seating, since at least half of the total capacity would be recyclable from what we already have, and prep/site acquisition costs would be a fraction of that on the dock.

Yes, we may forfeit some of the prestige of the waterfront site (next to a sewage plant, and over 1 mile from the city centre) but at what point do those mysteriously exorbitant costs, and other concerns regarding infrastructure costs become too much? How does the cost-benefit work out if we're speculating about doubling or trippling matchday income "just to stand still"?

You've simply illustrated the reason why so few large clubs have moved. Why it is especially difficult outside the far richer and more expansive corporate offer in London. As Evertonians, we are surely most interested in what gives us the best deal and/or the stadium we need, not just the best sell-on value for any transient ownership? Not all are necessarily mutually inclusive.

31 Posted 31/12/2018 at 11:14:45

I have to admit, I am astonished at the difference between matchday income per head at the likes of the RS compared to us – I actually had no idea the gap was so great in that department.

Finally, I agree with others who mention that we perhaps only fill our ground because of the rock-bottom prices – I have friends who support non-league clubs with season tickets around two thirds the price of ours, while the likes of Arsenal's season tickets start at over double the price of the most expensive of ours. It would be interesting to see a survey showing what price our fans would be willing to pay.

32 Posted 31/12/2018 at 11:26:20

Appreciate your detailed reply, Tom, thank you.

#31 Michael, thanks for your comments, the 4k figure is the figure the club believe they can sell. I challenge that strongly. We've the best part of 5 years to grow our corporate/premium client base. I don't expect us to sell as many as Liverpool (8k) but I don't expect us to only sell half their figure neither. As a business we need to set much more demanding targets and either work harder or smarter in reaching them.

33 Posted 31/12/2018 at 11:59:17

There are sound business reasons for concessionary prices for kids and young people; they are the future of the club. With the best will in the world, I am not convinced the reduced prices for seniors can be justified to the same extent. People are living longer and in many cases working longer than they were a generation ago. For those of us who have attended every game for decades, demand is inelastic and not susceptible to price adjustments, up or down, within reason of course.

On the catering front, the club would need to improve its offer significantly above the current standard to persuade me to partake before, during or after the match. Unfortunately, bog standard lager and keg ales are the norm at Premier League grounds. An exception is Brighton where on Saturday we enjoyed a real ale, Harvey's Sussex Bitter at ٢.50 per pint, both inside and outside the stadium. That proved to be the high point of the afternoon.

34 Posted 31/12/2018 at 12:37:32

Having the opportunity to stand, sit or walk around a small area and arrive earlier and stay later would be of interest until a time when these boxes could be fully loaded.

I still think the enabler for the stadium is USM.

35 Posted 31/12/2018 at 12:41:20

Everton are committed to ‘Equality and Diversity' so I would hand out free tickets to unemployed people and low-income families who can't afford football these days thanks to Sky in the area. I believe Naismith used to do it (what a superb bloke).

They won't fill a 50,000 stadium and definitely not a 60,000 one anyway. But of course they won't give free tickets because it's bullshit — the only Diversity will be the lawyers, consultants, building firms et al from London who employ their own people. Well done, Everton In The Community!!

36 Posted 31/12/2018 at 12:50:33

Everton's new stadium plans could be sunk by rising sea levels, warns academic

37 Posted 31/12/2018 at 13:13:40

38 Posted 31/12/2018 at 13:22:17

I asked Dan Meis that question and he said it was costed in.

Joe #37

Kirkby was 50,000. I think the Kings Dock was around 60,000 but not absolutely certain on that one.

41 Posted 31/12/2018 at 13:30:44

I was pondering the same thing. Obviously they hope to attract new fans with money to spend. But they don't want to price out the true long-term fans. So why not have some kind of means test? Doesn't have to be complicated, proof of address, reportable income.

Okay, you make x amount, you pay this price; someone else is a millionaire, they pay full price. It would keep long-term fans on board plus allow for increased revenue from newcomers.

42 Posted 31/12/2018 at 13:51:47

Basic season ticket price stays low;

Silver Season ticket holders have a lounge with nice carpets, and also get the FA Cup and League Cup matches thrown in;

Gold Season ticket holders get a lounge with nice carpets and a free bovril, and to access priority away tickets and tickets for any semi or final we reach at wembley;

Platinum Season ticket holders get all of that plus the chance to meet with the first team once a season and a free pie at every game;

Super Platinum members get to meet the team and throw their free pie at them if they lose to Brighton.

43 Posted 31/12/2018 at 13:59:05

Free Bovril? Sign me up.

44 Posted 31/12/2018 at 14:05:18

Thank you.

Michael @ 42,

I wholly agree and lol'd to your last sentence.

45 Posted 31/12/2018 at 14:13:52

I appreciate the glamour a riverside stadium may bestow but since Mr Moshiri bought in the city has failed to get the Commonwealth Games hosting rights (and the alleged cost of Bramley-Moore Dock promptly rocketed upwards according to EFC themselves), then the Brexit fiasco reduced the value of the pound sterling by a very significant amount with no hint of its restoration, and various managers have pissed about a quarter billion on players with little heart, ability or sell-on value as they sit out their lucrative contracts with us.

So, can Moshiri still have the spends for the very expensive Bramley-Moore Dock whilst our travails on the pitch persist, or is he forced to choose between investing in better players to keep the faithful who attend or does he continue to expect M&M to make silk purse players out of cow's ear talent with negligible player investment whilst Lord knows who is involved with the real decision-making inherent to coining a fortune, eventually, from a very derelict Ten Street area and beyond?

Oh, and Happy New Year folks.

46 Posted 31/12/2018 at 14:23:27

47 Posted 31/12/2018 at 14:28:01

Tell me, if Goodison was all season tickets and you were on a waiting list and not able to go, would you not class yourself as a fan?

48 Posted 31/12/2018 at 14:49:31

We have only had a waiting list for season tickets in the last 12 to 18 months so that argument doesn't hold water.

As for suggesting fans like me had gone you mean fans like me who have been going to Goodison since 1956 and had a season ticket for 50 years? I hope not.

49 Posted 31/12/2018 at 15:00:25

We are all fans; just cause you have a ticket does not make you more of a fan than the rest of us

50 Posted 31/12/2018 at 15:09:09

Can't see 62k turning up to a home game against a Huddersfield or Burnley. Thousands of empty seats won't be great for atmosphere...

One point you do highlight though is the chronic shortage of corporate and premium seating at Goodison Park. Hopefully any new stadium will address this to boost matchday revenue.

51 Posted 31/12/2018 at 15:17:54

I watched most Everton home games and lots away faithfully for some 13 years up till 1968.

I then had to move, age 17, from Crosby to Southampton for 3 years work with the Ordnance Survey, then joined the Navy for 14 years – then worked offshore worldwide for 14 years with another 17 years in Texas (managed to get to all USA games and a couple back in UK).

You were bloody lucky, Sir, to find work at home for all those years – don't be so naive as to comment on the fact that we are not true Evertonians... what a ridiculous and outdated attitude to have... from an angry overseas, nee Scouse, bystander!

52 Posted 31/12/2018 at 15:23:15

I suspect Brian Harrison's remarks were an emotional reaction to Jamie's ill-informed remark. But, as someone now living overseas, I think Brian Harrison has a point if we differentiate 'fan' from 'customer'.

You could be the biggest fan (derived from 'fanatic') in the world with Mark Ward and Preki tattoos on your face, spending every waking moment reading classic matchday programs, but if you are banged up in the Bangkok Hilton, you cannot go to games. Doesn't mean you are not a fan.

However, the bottom line is that Everton is a business and all decisions regarding the ground should be based around the consumers, ie, the paying customers. I live in Kansas City now so cannot go to games, ergo Brian Harrison's disposable income, needs, and views are more important than mine from a practical business point of view.

He isn't "more of a fan" but he is a regular paying customer and we are talking about a stadium designed to meet the needs of such folks as opposed to TV access, the website etc, which cater to us.

53 Posted 31/12/2018 at 15:29:07

By my maths, you haven't told us of your attendance history over the last 2 years (3 years as of tomorrow). :-)

54 Posted 31/12/2018 at 15:41:47

Yes, I did make my comments after Jamies remarks over increasing the price of tickets, and it was an emotional response. I apologize if I went too far... just got a bit annoyed that someone who obviously lives a long way away – and because of which can't get to the game – suggests that match-going fans should pay more.

Also apologies to Gerry and Bobby, and I wish you and all Blues a very Happy New Year.

[BRZ]

55 Posted 31/12/2018 at 15:42:15

"I know we have a lot of contributors from far afield who believe they are Everton fans but, in reality, they aren't. There is only one definition of a fan — that is somebody who goes the game and vocally supports his football team."

Nominee for 'Bollocks of the Year Award', for this year and all years.

56 Posted 31/12/2018 at 15:45:57

Who are you to judge? I, much like most other TWers, welcome all comments from either overseas supporters, supporters who can't afford to go to all games, supporters who only go to a few games, supporters who choose.... Most of all, I never judge; I will leave that to the good Lord.

57 Posted 31/12/2018 at 15:52:11

Maybe you'll be a changed, less bitter, more tolerant and charitable man in 2019, but I very much doubt it. Happy New Year, Don.

58 Posted 31/12/2018 at 15:52:43

I don't suppose there is a trophy for the "Bollocks of the Year Award"?

59 Posted 31/12/2018 at 15:57:44

60 Posted 31/12/2018 at 16:02:27

Thanks, just an old guy getting a bit carried away.

61 Posted 31/12/2018 at 16:04:56

Happy New Year to all Blues everywhere, especially Michael & Lyndon for this wonderful site, which is a precious link to Evertonia for those of us away from Merseyside.

Cheers, everybody!

62 Posted 31/12/2018 at 16:13:21

I am sure Michael won't be happy, but I thought your horse Getaway Trump ran a blinder in the Challon the other day.

What's next on the agenda... Cheltenham?

63 Posted 31/12/2018 at 16:16:12

Each club with a new stadium, how did they get bigger attendances in a bigger stadium?

We can have arguments for and against. Example Arsenal, Tottenham, West Ham, oh they're London clubs. Cheap season tickets for West Ham.

Not every club who's moved are in London!

There will be a 'new stadium' bounce. Sustaining it is the key. Success on the pitch is the key. Good pricing is the key. New fans will be found.

So what if there is the equivalent of Leicester at home at 12:30 New Year's Day that doesn't fill up? Does it have to be full? Jeez, look at some highlights from Goodison in 1984-85 some empty seats in the Upper Bullens.

If need be, they can block off banks of seats with advertising. Have a variable capacity.

64 Posted 31/12/2018 at 16:20:28

I think the differentiation (is that a word) should be between fan and supporter.

To me a 'fan' is someone who watches a team on the telly and likes them.

A 'supporter' is someone, to me, who spends money in the following of their team.

Using that differentiation (if it's not a word can it be made one please) then a supporter should get a "vote" on things where a fan shouldn't really.

That's not me being a "better supporter" than anyone else to me that's just common sense.

I think I can see what my namesake meant, he maybe just posted it as someone may say it in Jay Woods virtual alehouse.

I think the difference is recognised by the club, and probably any other club, in that season ticket holders and Evertonia(?) members have been contacted several times for their views on the new stadium among other things.

Somebody who's a fan is quite entitled to an opinion of course as is everybody who posts but I can understand someone who pays every other week to go and watch the game being not exactly pleased with someone who doesn't go at all suggesting a price hike or other things which won't directly affect the one suggesting it but could make a big difference to the other person.

Can nobody else see that?

65 Posted 31/12/2018 at 16:32:33

I agree. One thing I would say regarding say the Arsenal model.

I used to work part-time at a working men's club in Harlow, Essex that my Grandad frequented. The regulars were working class plumbers, bus drivers, builders etc decent sorts but mostly from London who had moved the 20 miles to Essex for work etc. Many of them were season ticket holders at Highbury as their fathers and grandfathers had been.

However, once Arsenal moved they were soon priced out. It was sad, a few of them started going to watch Leyton Orient, some made do with TV, others were just disillusioned with how their local club had lost its roots.

Around the same time, a lot of my mates in neighboring Hertfordshire (bankers, white-collar types) all of a sudden started getting season tickets for Arsenal. Granted, they showed up for most games, but talking to them, Arsenal "legends" begin with Thierry Henry, and few of them even knew much of the George Graham era.

Personally, I think it is sad some of my old relatives like my Great Uncle Stan – true Arsenal fan even died watching a match – with roots and family traditions have been pushed out, and my fairweather mates who probably would have bought season tickets for a freaking ice hockey team were it there instead of Arsenal have assumed their legacy.

I am not anti- new fan by any stretch but I hope Everton find a way to hold onto the local tradition and the community whilst obviously raising revenue and getting new fans.

66 Posted 31/12/2018 at 16:34:21

I, too, enjoy a discounted senior season ticket @ 𧷕 for the Upper Gwladys Street stand. I also get free train and bus travel to Goodison so each League game costs me 㾻, in total, and even less for most cup games.

In today's world that's exceptional value (even for some of the dross we have to endure) and I'd happily pay more.

Everton discount for young and old but I'd really like them to offer something to those on benefits, even if I had to pay a little more.

However, I also appreciate that others may be struggling, and any price rise may prove difficult for them.

67 Posted 31/12/2018 at 16:34:51

68 Posted 31/12/2018 at 16:37:08

69 Posted 31/12/2018 at 16:40:53

"Who cares how many times you or I or anyone else goes to a match?"

Well... Moshiri cares, and LCC care if they end up underwriting the new stadium.

Whether we like it or not, there is a commercial side to the new stadium debate and we have to cater to matchday attendees, whether you want to call them supporters, customers, fans or whatever.

It isn't a way of disparaging others who aren't in attendance; it is just a practical reality.

[BRZ]

70 Posted 31/12/2018 at 16:44:42

Check the timing of our respective posts @ 54 and 55. Quite clearly, you were penning yours at the same time I was penning mine.

Jamie, very tentatively, made a fair point on ticket prices, unpalatable as they may strike you. It didn't merit the judgement call response you made on what defines a 'true fan', which you have now gracefully acknowledged.

This is a prodigious article and analysis by 'the Esk', for which he merits great praise. The article is slewed toward Paul's belief that a larger capacity stadium NOW would be cheaper and more beneficial long-term.

Without knowing the details on the first build of the new stadium and the capacity to add a further 10,000 seats in the future if needed AND the club's ability to have close to maximum capacity on each and every match day, it's really difficult to make a definite call on which is the best option: go with Paul's larger capacity now, or only expand when there is an evident need later which appears the club's current preference.

Like many others, I'm sure, I'm anxious to see what the stadium is going to look like. The New Lane for Spurs looks amazing, for example.

71 Posted 31/12/2018 at 16:45:21

Just seems a bit unfair to me. We're all suffering blues!

72 Posted 31/12/2018 at 16:46:04

Also, I believe there IS some difference.

To those supporters who travel to all the away games and gain credits by doing so, credits maybe for cup games etc, do they deserve those more than me, a season ticket holder who doesn't go to any away games?

You bet they do. They give up more time than me and spend more following the team than I do and I have no problem whatsoever in them having preferential treatment when it comes to certain things.

Doesn't mean they love Everton more than me but their commitment is certainly more than mine.

73 Posted 31/12/2018 at 16:53:07

74 Posted 31/12/2018 at 16:57:15

If Everton take up the LCC offer, the risk of Everton defaulting on repayments would be underwritten by others and not the council.

There would be no financial risk to LCC so, from that perspective, they wouldn't be unduly concerned at how many turned up to the new stadium.

75 Posted 31/12/2018 at 16:58:40

I was thinking similar to you, in that a fan is someone who likes a particular team but, for whatever reason, cannot attend a match, whereas a supporter is someone who supports the club, either in a vocal or financial sense, on matchdays.

However, due to online shopping, I guess we can now all be classed as supporters. The likes of Jamie and Mike Gaynes, who live thousands of miles away, can now support the club in a financial sense, simply by buying Everton merchandise online.

Okay, they might not spend as much as someone who buys a season ticket etc, but I suppose they would still be supporting the club in a financial sense.

76 Posted 31/12/2018 at 17:02:49

Cheers Brian, we were all thrilled with Trump's run.

I know he's come out of the race well.

Not heard anything yet but I'm guessing he'll have one more run and all being well it'll then be Cheltenham/Aintree. He's versatile ground & trip-wise, so there's a few options. We'll leave that to Paul Nicholls.

It was good to get some sporting joy on Saturday!

77 Posted 31/12/2018 at 17:03:14

Didn't spend much in the Midland though. Lol.... Joking, Mike 😉

78 Posted 31/12/2018 at 17:12:19

79 Posted 31/12/2018 at 17:20:23

Back then, all the games were at 3pm on Saturday. We had none of this Monday night, Friday night, Saturday midday nonsense. Also, licensing laws required pubs to close at 3pm.

Moreover we didn't have the 24-hour society we have now. Banks closed for lunchtime and were not open on Saturdays. High Street stores generally operated 9-5. It was a different world.

Most people had Monday-to-Friday jobs, fewer distractions (only 2 TV channels to watch, no internet) so it was not surprising we had huge crowds at football games.

80 Posted 31/12/2018 at 17:32:25

Seriously though it's all gone pear-shaped in the 30 years he's been in the boardroom, most of which he's been top dog. I refuse to accept he's not therefore majorly responsible despite his perpetual bleatings about having only been waiting for the right offer to the benefit of the club. Yeah, right.

Others I respect on TW have met him and don't rate him at all as a genuine guy. Many in his theatre-land world have the same low opinion of him but the self-proclaimed fact that he "gets" Everton is evidently enough for some of us.

Happy New Year, though.

81 Posted 31/12/2018 at 17:34:46

I do still owe you guys a round of Guinness. And I'll make good next time.

Regarding your main point in #64, I think it's a distinction without a difference unless you could somehow establish a clear line where "fan" ends and "supporter" begins... which of course would be impossible. Everybody's definition would be different.

But I must admit I'm reticent to comment on any of the stadium threads presented here, even one as brilliant as The Esk's, because my butt won't be in those seats.

82 Posted 31/12/2018 at 17:38:33

83 Posted 31/12/2018 at 17:41:11

84 Posted 31/12/2018 at 17:42:36

85 Posted 31/12/2018 at 17:47:46

86 Posted 31/12/2018 at 17:52:50

Forget Kenwright. He is just a dusty old heirloom destined for the jumble sale. Rayazantsev handles the money, Brands handles contracts, Helen is the public face of the club. Bill's only role now is as the warm-up act for Ian Snodin's after-dinner speaking engagements.

87 Posted 31/12/2018 at 17:54:46

Fingers crossed, mate. 😉

88 Posted 31/12/2018 at 18:09:15

89 Posted 31/12/2018 at 18:16:39

Who is this Helen of which you speak?

Denise?

90 Posted 31/12/2018 at 18:30:19

52k or 62k — does it matter? When the football being played is shite and the club operates with a view to only staying in the Premier League we will become irrelevant.

91 Posted 31/12/2018 at 18:31:46

Keiran – wear a red rose and carry a copy of the Grauniad!

92 Posted 31/12/2018 at 18:44:07

93 Posted 31/12/2018 at 19:05:29

1. The issue of discretionary spend by fans within the stadium does not seem to be covered in your article –unless I missed it which is very possible. What contribution to revenue would an additional 13k fans spending 㿊 and an extra spend of 㾶 for the 39k fans currently attending make? I make it around 㾻 mill gross pa.

2. The previous board were reported to have outsourced all catering etc at a pretty poor deal. Do you have a view on whether better arrangements in the new stadium could affect matchday spend?

Thanks for your attention.

94 Posted 31/12/2018 at 19:14:37

On the basis that the Bramley-Moore Dock project isn't fiction, it will progress to completion and hopefully the design will be optimum and future-proof so it gets built at 60k and no need for further plans and costs in the future.

This will be the real deal but the real deals must be done on the team and it will take time. The more you think and learn, the less you know, in my view.

But the clock's been running and the focus to rebuild and strengthen the squad can't falter; next season, as the most famous cliche used, “is massiveâ€. What happens to massive after 30 years, in the wilderness?

Let's hope for a far better 2019 for EFC. Surely that's something that can be done based on our results this last 12 months?

All The Best, TWers And Your Families, for 2019.

ðŸºâ˜˜ï¸ðŸ¤™ðŸ™‚âš½ï¸ðŸ‘☘ï¸â˜˜ï¸â˜˜ï¸ðŸºðŸºðŸºðŸº

95 Posted 31/12/2018 at 19:44:52

Well, here's the thing regarding fans, distance, etc. I actually agree with you.

There is an unquestionable difference between those folks born in Liverpool, who live there, and who pay their hard-earned money to see the team in person. They are fans, no question.

I'd also not – ever – say a person who lived in Liverpool, or has roots in Liverpool, that lives far afield now, is any less a fan.

What is true is that dudes like me – "adopted" as I like to call them having made a "choice" to "support" Everton – are on a different level. To me, that makes sense.

Now we can go on all day long about how the Club has consumed me, how I passionately root from the TV and computer (usually in wonderful weather, sunny as hell), and how I buy merchandise direct from the Club, pay TV subscriptions, talk the Club up to "emerging" fans here, name my over-40 7 a-side team "Grand Ol' Team", pay to be a TW patron to support the constant flow of Blue discussion via the web (it's all I have in college football country!), etc.

In short, I do indeed do my part, but as you say, it's not on the same level. To argue it is would be inane in my opinion.

But! (You KNEW that was coming!) -

To discount the suggestion that we are leaving money on the table, and our average matchday ticket price can and should be increased, simply because the source is from a man in a country who's record in world wars is undefeated (!), is folly. Keep your sense of humor as I toss out ugly American jokes please.

I said it with great trepidation – I thought that was abundantly clear. And I knew someone, likely multiple persons, would take umbrage based upon the fact I don't / can't attend.

All of that doesn't discount the fact that getting into a professional sports event for under $50 is frankly too damn low if you want to increase revenues. As I said in my final sentence, it's a business decision.

Forget the source, Brian. Forget I said it. Let's say Eugene Ruane got on here, or John Daly, Derek Knox, Colin Glassar, the Abrahams Clan, any of the TW all-stars (leaving out a damn good many people by the way).

What would you say to them, without the retort of, "American, you don't contribute, rich of you to suggest an increase!"

What then Brian?

Ticket prices can and should increase. Sorry man. No-one likes a price-hike. But sometimes they simply have to happen for companies to raise revenues and stay competitive.

Happy New Year. Chat with you tomorrow from the Blue Barstool in America!

One last thing, you say:

I know we have a lot of contributors from far afield who believe they are Everton fans but, in reality, they aren't.

Brian, my friend, you are wrong. Yes, I am an Everton fan. Really, in reality, I am.

When I finally make the pilgrimage and break my Blue Cherry, please be around to celebrate with me. I plan on getting blind drunk, we'll have a whale of a time.

96 Posted 31/12/2018 at 19:54:21

I retired from work and moved back from the USA to live back in Aberdeenshire last year and haven't managed to afford to get back down to Merseyside – I will do at some time next season though I hope.

I wish I could as I try to watch them online, but nowadays I get so bloody frustrated and fed up with their inconsistency that I tend to take the dog walkies half-way through... less stressful on my 68-year-old heart.

97 Posted 31/12/2018 at 19:55:48

"Ticket prices can and should increase. Sorry man. No one likes a price-hike."

That sentence should be altered to say "can and could" not "should" because, like any business decision, there is a choice to be made. On the one hand, yes you could increase prices and you may get some more affluent fans to show up. The trade-off is that at 40 or 50 quid per game, you would certainly lose a lot of long time fans because simply put, a lot of folks in Liverpool have limited income. So they question is, do the club want to risk losing those fans in pursuit of more affluent folks?

Okay, it seems to have worked out for Arsenal (as long as you don't mind selling tickets to people who don't show up for games) but London has 8 million people and is far and away the wealthiest part of the UK. Yes, people in America pay $50 per game but say here in Kansas city where I live, you are talking about just eight home games in the regular season.

If the Premier League was set up similarly, and we only played say the big 6 at home plus maybe Newcastle and Aston Villa, then yeah we could sell out 62,000 at 㿞 a pop. But 19 home games against teams of variable quality, plus cup games v Lincoln city, it is a different story.

The Kansas City Royals baseball team have many more games, but firstly, they are often in front of empty stadia, secondly they do have some really cheap tickets at $15 a pop. So it is not really comparable with the set-up in England.

98 Posted 31/12/2018 at 19:59:59

No matter where you are as an Evertonian.

No matter from when you were - an Evertonian...

Let me wish you all a very Happy New Year from Turriff in Scotland (currently booming to "Hogmanay in the Haughs with the Red Hot Chilli Pipers"), and special thanks to Michael and Lyndon for their fabulous work on the ToffeeWeb site.

99 Posted 31/12/2018 at 20:03:52

There was nothing to apologize for. You didn't say anything unexpected or overtly rude. It makes a hell of a lot of sense for your reaction to be, "Whoa, whoa, whoa, hold on there little Yank!"

100 Posted 31/12/2018 at 20:05:38

The club will cut its cloth and the price of progress in life et al general, is that to progress, you must flex, and adopt, and sometimes there's price hikes, but I'm sure that Evertonians everywhere will respect any changes in costs.

The club is trying to evolve, and in my view to be sustainable and viable 60k, would cut it... The site alone and position is what we are playing with.

Great debate!

101 Posted 31/12/2018 at 20:05:59

Understand your sentiments, but it's my opinion. As such, "should" is the appropriate word, as I believe the ticket prices should increase.

Not could, and can and could... should.

My opinion, hence the word usage.

102 Posted 31/12/2018 at 20:07:12

103 Posted 31/12/2018 at 20:12:55

I'm well aware there's not a hell of a lot of vacation homes around Goodison Park.

I still believe an increase in ticket prices would be a wise business decision.

104 Posted 31/12/2018 at 20:16:19

Fair enough. My opinion is that, when some joker like Alexis Sanchez says "I want to be paid 𧼩,000 a week for sitting on my ass on the bench and throwing hissy fits," that club owners should say "You're having a laugh mate," and send the three spirits of Christmas to take him on a tour and see how Tiny Tim dies cause his dad Bob Cratchet spent his last 𧴜 buying a match day ticket.

I guess my wider point, which obviously Everton cannot address alone, is that we have let the inmates overtake the asylum, as it were. If any of us real world workers demanded to double or treble our salaries every few months, we would be out of a job.

105 Posted 31/12/2018 at 20:23:38

Alexis wasn't on my Christmas Card list either.

Fair enough. Point definitely taken.

By the way, I was listening to Talk Sport just yesterday (pretty sure it was yesterday) and they were discussing Sanchez.

I thought to myself, why doesn't Man Utd simply refuse to pay his wages, citing breach of contract and making the argument he's not living up to the contract in good faith?

Dicey, controversial, and probably not a winning legal argument. But with the money they have, why not blow a few thousand on legal fees and send a statement?

Stranger things have happened.

106 Posted 31/12/2018 at 20:26:22

Happy New Year, to everyone on ToffeeWeb, especially Lyndon & Michael, who continue to keep locking us in the asylum!

107 Posted 31/12/2018 at 20:29:17

Slightly different scenario but Chelsea have used the legal route a few times. They stopped paying Mutu when he failed a drugs test, and successfully sued him for 㾻 million. They also forced Casiraghi into retirement when he wanted to keep playing after an injury.

They managed to win a case of their Doctor versus his to say he was too injured to play any more, end of his career; they got a nice insurance payout. So it's not beyond the realms of possibility.

108 Posted 31/12/2018 at 21:23:16

Like it or not, Everton are merely the sprat to catch the mackerel in this scenario. Usmanov most probably does not crack empty nuts so there is a very good possibility that Russian Steel will find its way to the Liverpool Dockland...

He will use his resources to Peel the skin off a very lucrative banana/investment.

109 Posted 31/12/2018 at 21:38:27

110 Posted 31/12/2018 at 22:36:25

Everton "should" strive to always keep themselves affordable to their core fanbase. Of course, prices would sensibly move with inflation and more expensive seats, boxes etc will be exploited I'm sure.

As for this 52k or 62k argument? It will surely end when the drawings of this fuckin stadium are released for the time taken so far they will have to be extremely detailed and accurate.

It's funny but I think 56k or 58k would have pleased most people myself included but 52k only a few thousand less has caused so much debate.

Fans like Jamie should be welcomed by the way like all our overseas fans as it's obvious they're not fuckin glory hunters!!

111 Posted 01/01/2019 at 00:55:14

Now he might have listened to some tossers like Jimmy Whyte and others on football matters, but he must by now 'know the cries' as is said, in business.

He will know what his bottom line is... 52,000 @ £xx per person... and his only task will be to gauge how much jam he can put on top of that before the punters do one.

It may be our Club, but it's his money up front and he will, I hope, not try to force feed the Premier League / Sky Golden Egg laying Goose too much so it chokes.

To rework the old General Motors quote, what's good for Moshiri's money will, by enlarge be good for EFC.

112 Posted 01/01/2019 at 09:57:36

113 Posted 01/01/2019 at 10:17:45

Size does not equate to performance, nor does it equate to atmosphere or results on the pitch. The Premier League did a poll and some of the best atmospheres in the Premier League are seen at the smaller grounds such as Selhurst Park and the Amex (Brighton), with St James Park being noted as the best atmosphere in the division – guess how many people St James Park holds? Yeah, that's right... 52,000.

Of course this is subjective, but Goodison Park is a very middle-of-the-road ground when it comes to atmosphere, which is something created by the supporters themselves, not the amount of them.

I can't help but think this is all just a load of willy-waving from people who just want to see us out-do them lot over at the cabbage patch in terms of capacity.

114 Posted 01/01/2019 at 11:13:33

The club have announced that two stands (presumably behind both goals) will accommodate rail seating. It's not clear but presumably the 52,000 doesn't include any increase in capacity with safe standing?

Apparently at Hannover, 5,700 fans stand in an area of 3,000 rail seats. So, if we had 12,000 rail seats (I made this number up) and were allowed to fill to the same level as Hannover, that would be 22,800 standing fans and a total capacity of 62,800.

Someone might want to check my maths. Imagine the atmosphere!

115 Posted 01/01/2019 at 11:18:57

As you say, it's not a problem to curtain off whole sections of empty seats for less popular games, the problem is that those sections cost anything from £1000 to £10,000+ per seat each to build. As the capacity goes over 45k, you can edge towards the top of that range, and that cost then becomes prohibitive. Then, approaching the issue from another angle we can then create a supply-demand conflict, where over-supply can then affect pricing strategies (a la west ham). The club could argue that we currently have to charge peanuts compared to our neighbours to fill a smaller stadium. Of course we could argue about the detrimental effects of obstructed views and poor product too. I'm sure Paul will elaborate further on new stadium effect and potential demand etc, but it isn't always a given.

While it is possible for a small club to sell their old ground and release sufficient funds to pay for all or most of a new 10-15k build, it becomes very difficult for larger clubs, unless they sit on some really highly sought after real estate.

Of all the larger northern clubs only Sunderland have paid for whole new over 40k stadium which was a rather basic bowl design sitting in a partial crater, and then City, which was the proverbial freeby. Whereas LFC, NUFC, Villa and Man Utd have all redeveloped with varying degrees of success.

Arsenal had no choice, they had a smaller ground than GP, and a very long waiting list even at their prices. Their old stands were listed and couldnt be altered to accommodate more corporate. They were more land locked than us, surrounded by far more expensive housing. They had a new site just a few hundred metres away and were able to generate a good return on the sale of Highbury. Their new corporate tiers at the Emirates generate more income than the whole of Highbury. Spurs are hoping to do similar on the same site as their old ground again tapping into the massive corporate demand in the capital. West Ham again getting a freeby.

I am not saying it isn't possible for Everton to do similar, just that it might be more difficult, or that there might be an easier solution. Any stadium move is to some extent a leap of faith, and we have to be able to identify and measure the risks and opportunities to be able to make pertinent comparisons for all the options. That's not being sceptical more about trying to be discerning and open-minded. More articles like Paul's allow us to at least consider those options. More power to his elbow and anyone else's who wishes to delve into the process that is essentially the club's biggest single decision since 1892.

116 Posted 02/01/2019 at 10:59:43

It cannot do both at the lower end of the capacity range (52k).

#114 Tom, your last point is the key. As a fan-base, we need to discuss the implications of a stadium move. It would be enormously helpful if the club provided the data they have used to make the proposals we have seen to date.

Add Your Comments

In order to post a comment, you need to be logged in as a registered user of the site.

Or Sign up as a ToffeeWeb Member — it's free, takes just a few minutes and will allow you to post your comments on articles and Talking Points submissions across the site.

, placement: 'Below Article Thumbnails', target_type: 'mix' });

1 Posted 30/12/2018 at 20:49:50

However, as finance is a major driver here, I throw in a curve-ball – USM throws in 𧴜 million of steel through a dodgy deal with Peel Holdings for future steel contracts for the other major projects that will follow after our new stadium is completed.

Bramley-Moore Dock is the driver behind the Peel Holding vision for the docklands projects and would be in everyone's advantage to make this move:

We get a huge steel discount.

USM get preferential bidding for projects on the docks.

Peel Holdings get the docks project kick-started.

Win for all and reduces the cost per seats to approximately ٣.5k.

Whilst I have nothing to back up my curve-ball, I could suggest USM, as the sponsors of Finch Farm, the purchase of the Liver Building gives them an office suite to operate from; we need a bit of luck.

As an iconic waterfront stadium, I would like to think we would also attract a lot of other uses such as concerts, boxing etc.

The addition of external entertainment including bars and eateries managed by EFC would I believe generate a lot more than people expect. I personally do not use these facilities at the moment as in the main stand we have one bar and do not want to leave the game ten minutes early to get a pre-poured flat pint and cold hotdogs.

I could see myself potentially spending 㿀 per game if the facilities where of a standard, if this brought in a potential 𧶲k per hospitality over each game, that would generate ٣ million a year, this is without more shop sales. Obviously not just my 㿀 but 1 in 5 spending an extra 㿀.

As previously stated, I can't support this with hard facts but need to be aware of other business streams that are generated by new stadiums.