The minor shareholders in Everton Football Club Co Ltd have been dealt another potential blow in the latest move by Everton's new owners, Roundhouse Capital — the holding company established by The Friedkin Group — to hold ever-increasing numbers of what used to be precious Everton Shares.

Two resolutions were to today approved by the majority shareholders:

Resolution 1: Giving the Club's directors authority to issue a total of 1,142,587 additional ordinary shares.

Resolution 2: Disapplying statutory pre-emption rights to enable the club's directors to issue the shares required to affect the equity subscription by Roundhouse on a non-pre-emptive basis.

What this means is that minority shareholders have no pre-emptive right to be offered any of these new shares for purchase. This has the potential to further dilute the already small percentage of the company that is held by the minority shareholders from 0.5% to less than 0.3%.

This allows the club's directors to issue the necessary new shares to Roundhouse Capital, without having to go through the legal process of offering them to the minority shareholders beforehand.

It is a common step in major investments or takeovers, as it streamlines the process of getting new capital into the company from the new and dominant investor.

At the corporate level, it can be seen as a step that confirms The Friedkin Group's intention to obtain investment of further capital into the club in the future.

The club claims that will enable support of football operations, future projects and the ongoing development of Hill Dickinson Stadium through sustainable and strategic investment, in keeping with the ownership’s long-term commitment to Everton.

The Club also claims that the move has no impact on the rights or valuation of shares held by the minority shareholders, on the basis that any trading of shares is done privately and at a mutually agreed value.

Reader Comments (18)

Note: the following content is not moderated or vetted by the site owners at the time of submission. Comments are the responsibility of the poster. Disclaimer ()

2 Posted 24/07/2025 at 23:20:05

I finally got around to this, and found Paul Quinn had posted a copy of the letter on Twatter.

He seems to think it's all good news but I think it just renders the now highly marginalized minority shareholders, er, even more marginalized.

The acid test will come when there is sufficient demand for another auction of Everton Shares at Asset Match. In the last auction that closed on 29 November 2024, 72 shares traded at £3,400 per share.

The next scheduled auction is to be confirmed and will be announced once finalised. It will be very telling to see what the appetite is to both buy and sell shares — and at what value.

3 Posted 24/07/2025 at 23:26:41

These few remaining 'Legacy' shares appear to be further diluted down to less than £100? and are now bordering the realms of fairly expensive fancy toilet paper.

4 Posted 24/07/2025 at 23:51:02

5 Posted 25/07/2025 at 01:07:13

I too have little concern for the value, but I'll admit wishing it hadn't been devalued quite so quickly.

At this rate, my widow will have the choice of selling it for the price of a decaf mocha or scattering it at the ocean with my other ashes.

6 Posted 25/07/2025 at 01:19:03

Any recent 'for profit' purchasers will be a bit miffed though, collateral damage in the big business scramble.

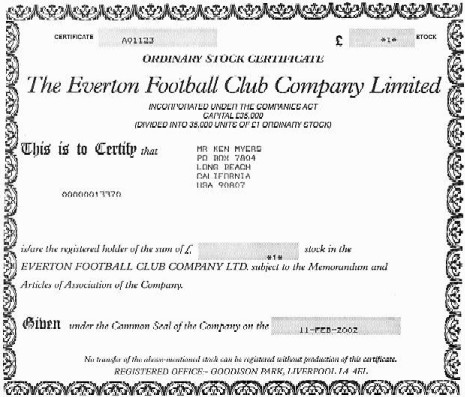

Edit; probably best off getting them nicely framed using acid free materials and hang them on the wall...in the manner of such things, maybe in 40yrs or so a couple might turn up as curios on the Antiques Roadshow or similar.

7 Posted 25/07/2025 at 02:28:18

Even if the actual underlying worth of the share was minimal, the share cert itself would probably be worth at least a grand (at a rough guess).

As you say, frame it and say "I own part of Everton Football Club".

8 Posted 25/07/2025 at 04:19:33

Somebody will no doubt do the research/sums and will be able to tell me;

a) how many shares + the new 1,142,587 that TFG now 'have' and thus give an educated guess at the price per share and thus the overall 'value' of the Club...I'm guessing at £1.5 Billion...but who real knows.

This will, hopefully give...

b) a nominal value of the Rump / Legacy shares.

With another 1.14Million shares thrown in the pot, you'd think that this must dilute even further the value of the Legacy Shares.

But if the Club - with its new monster share issue total - has been notionally 'Re-valued' Up, this will eventually have to be tested in the market place.

As an object is only worth...on the day...what somebody else is prepared to pay for it.

I happen to think for a Club in the Premier League & a brand new ground some might see £1.5 Billion is a bit of a bargain.*

*see 'The Other Fool' theory.

9 Posted 25/07/2025 at 06:10:14

"Everton Football Club confirm two written resolutions issued to shareholder have been passed, enabling the club to receive further investment from its ownership through the issue of new shares".

I will await the club to announce it and have no idea what the investment will be or where it will be spent.

10 Posted 25/07/2025 at 10:43:40

11 Posted 25/07/2025 at 11:04:42

“Everton have breached PSR on two occasions, resulting in separate points deductions in the 2023-24 season, and have needed sales in recent seasons to ensure their compliance in other cycles.

Before Moshiri's sale to TFG, and the subsequent writing off of the £450m in shareholder loans, Everton would have been particularly vulnerable under the new rules.

But under the new APT rules, the creation of new shares is the best way for owners to provide fresh equity for their clubs in a PSR-neutral way.

Roundhouse's actions, meanwhile, suggest that it plans to provide a further tranche of funding for Everton soon. This part, at least, can only be determined as positive for the club.

Expect moves of this nature to become commonplace across the Premier League, as owners look to find ways around the APT rules.

What happens next?

The cycle of change continues behind the scenes at Everton after TFG's takeover.

Roundhouse will almost certainly acquire the new shares soon, raising its shareholding to over 99.5 per cent and diluting the stakes of minority shareholders. Everton maintain that these share resolutions will not impact the value at which minority shares can trade, and that those prices will continue to be determined by scarcity.”

12 Posted 25/07/2025 at 11:52:28

13 Posted 25/07/2025 at 15:35:10

Supply of minority shares is low because most people want to hold onto them. Demand for minority shares is robust. Prices will remain high.

14 Posted 25/07/2025 at 16:52:07

Most recently, season ticket-holding shareholders were placed in the first tier when the allocation of seats in the new stadium began. For me, this was a priceless opportunity and, if my one share is now of extremely low cash value, I'm no longer bothered.

When we next get through to a Cup Final or Semi-Final, I would expect that STH shareholders would be at the front of the queue for these tickets as well. If I'm not mistaken, these and other perks were awarded in the distant past following the agreement not to receive an annual dividend on the shares owned.

15 Posted 25/07/2025 at 17:25:42

The club reserve around a 3% pot of away game tickets for shareholders. It doesn't guarantee a ticket; eg, for limited away ticket games such as Brentford and Bournemouth, you also need to be high up on credits.

I think it also gives you a 5% discount on shop purchases and programmes.

16 Posted 25/07/2025 at 17:40:09

There is also the EFC Shareholders Association, which is well-worth joining, in my opinion.

17 Posted 26/07/2025 at 02:35:21

If I recall their last tranche was bought at only £100 each? Meaning this would inject around £115 million into the Club, ie, our transfer budget?

18 Posted 26/07/2025 at 10:00:22

I think it was listed as £174.66 or something like that.

To my mind, it was a totally arbitrary and meaningless number in a sense because:

(a) TFG were investing a predetermined amount of money in the club;

(b) this so-called "equity subscription" is now the way to do it to avoid any APT scrutiny and PSR impacts;

(c) they could have created fewer shares and shown a higher nominal share value than £176.44;

(d) they could have gone with a lot more shares and shown an even lower share value!

It was so incredibly arbitrary. That last bit is essentially what they are doing now… but depending on how much is actually invested for the 1,142,587 this resolution makes available.

However, if — as people are claiming — it's the rarity of the minority shares that is the thing, and this could keep their value up, then it does not matter. We can only wait and see if Asset Match do another auction at some point.

Or, I could offer up my share for the emotional value it represents to me of £7,485. Any takers???

Add Your Comments

In order to post a comment, you need to be logged in as a registered user of the site.

Or Sign up as a ToffeeWeb Member — it's free, takes just a few minutes and will allow you to post your comments on articles and Talking Points submissions across the site.

How to get rid of these ads and support TW

1 Posted 23/07/2025 at 14:19:40

I think - but would be interested to hear confirmation - that the resolutions give the Directors authority to issue another 1,142,000 additional shares, but they will not be available for purchase by any body other than Roundhouse Capital Holdings Limited (Resolution 2 'Disapplying statutory pre-emption rights')